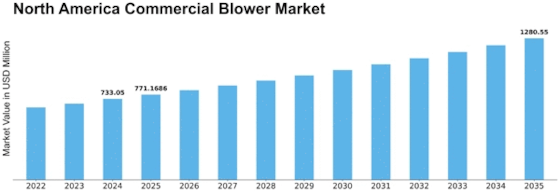

North America Commercial Blower Size

North America Commercial Blower Market Growth Projections and Opportunities

The North American Commercial Blower Market is influenced by a variety of market factors, which shape its dynamics and growth direction. One of the main pillars in this area is the strong industry sector down here. It can be said that North America continues to be a home for various industries such as manufacturing, construction, and agriculture; therefore, the demand for commercial blowers has increased consistently over the years. Government policies and actions also have a significant impact on North American Commercial Blower Market. This region has been increasingly focused on environmental sustainability and energy efficiency. Accordingly, there is an increasing need for commercial blowers that meet strict environmental criteria and save energy, too. This development is set to prompt more innovation in this sector, thereby leading to the production of highly efficient and environmentally friendly blower solutions. Market trends are another vital factor influencing the commercial blower industry in North America. There has been an increased adoption of smart technologies as well as the integration of IoT (Internet of Things) features into commercial blowers. Manufacturers are currently concentrating their efforts on smart blowers that incorporate improved control, monitoring, and automation capabilities within them. Economic factors also play a major role in shaping the North American commercial blower market. The state of the economy in terms of GDP growth and consumer spending, including investment trends, has an overwhelming effect on the demand for commercial blowers; hence, its demand would be driven by these factors; therefore, they are directly proportional to each other. In most cases, when there is economic buoyancy, people get involved in many industrial activities, hence increasing the demand for blowers across all sectors. Competition among players within the market is intense, with numerous key players fighting for market share. Pricing strategies, product innovations, and general market forces are some influential aspects that contribute significantly to competition levels here. Global events have also had impacts on the North American Commercial Blower Market concerning geopolitical issues and others connected with international exchange. These global trade rules, tariffs, and geopolitical tensions have a bearing on the supply chain, impacting components' availability and pricing in commercial blowers. These factors are even more important to market players who rely on them to make informed choices about their business undertakings even as they adjust their operations due to changing political environments. Moreover, customer preferences and evolving industry needs also shape the market dynamics. In North America, end-users increasingly demand customized and application-specific blower solutions that suit their unique requirements. This is why manufacturers that provide tailor-made solutions along with excellent customer service can gain a competitive advantage in this market.

Leave a Comment