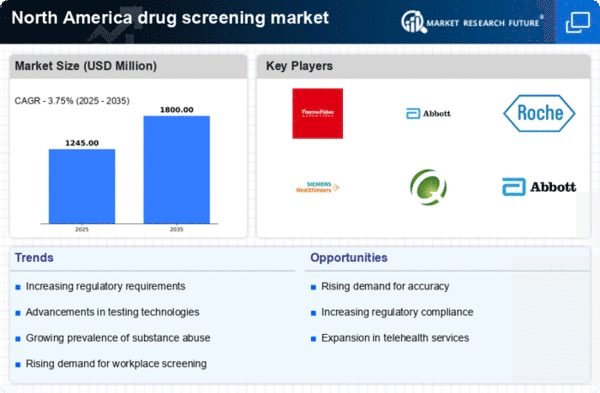

Market Share

North America Drug Screening Market Share Analysis

The drug screening market is a dynamic and evolving industry that plays a crucial role in ensuring workplace safety, compliance with regulations, and public health. As companies and organizations prioritize substance abuse prevention, the competition within the drug screening market intensifies, prompting businesses to adopt effective market share positioning strategies. Market share positioning determines the company’s place in relation to its competitors. The drug screening industry sees companies adopting several strategies to increase their market share with a goal of capturing more customers who will also translate into higher revenue. What seems to be a critical strategy for companies in the drug screening market includes remaining at the cutting edge of technology. Continuous innovation in testing systems, tools and software do not only attract new customers but also retained existing ones. Fast response to breakthrough technologies like enhanced methods of detection, and instant testing policies can differentiate a company from the competition. Competent market guys working in the field of drug screening understand that it is crucial to provide a wide selection of testing services. This covers the urine, saliva hair follicle and blood tests to enable them meet diverse demands of other industries and regulatory needs. Diversification does not only increase the customer base but also increases market robustness of a company. Geographical extension is a key strategy for achieving wider market share. Companies forge strategic alliances, partnerships or acquisitions to gain access into new markets and strengthen their position in the other ones. Agreements with health care providers, laboratories and regulators make up a complete established market position. In consideration of the stringent rules that govern drug testing, compliance standards are an integral part and non-negotiable factor in market share positioning. Through rigorous quality assurance, certifications and compliance to industry guidelines helps companies in developing a reputation for reliability as well as trustworthiness that are important factors to capture market share. In order to capitalize on the specific requirements of their clients, companies that have been successful in this drug screening market pay much attention to customization. Customization of their solutions to different industries’ requirements, regulatory environments and company policies guarantees customer satisfaction. A client-focused strategy enables the company to secure loyalty and positive reputation, which leads it towards market leadership. In a market with competition, price is key. Companies that provide affordable solutions without compromising on quality enjoy a competitive advantage. Besides, creating a good value proposition like quick turnaround times and quality analysis with superior customer service increases the attractiveness of an organization in terms of winning new customers. The marketing strategy is vital for the market share positioning because it helps build a strong brand presence. Companies invest in creating awareness, highlighting their unique selling points, and establishing themselves as industry leaders. A robust online presence, participation in industry events, and targeted advertising contribute to a compelling brand image. As the drug screening industry is in a constant state of change, on-going training and education are essential. The companies that invest in training their staff and providing education materials to its clients are a niche of experts. This not only increases credibility, but it also boosts confidence among customers in regards to the effectiveness of their products and services.

Leave a Comment