Aging Population

The demographic shift towards an aging population in North America serves as a significant driver for the vitamin supplements market. As individuals age, their nutritional needs evolve, often requiring additional vitamins and minerals to support overall health. Research indicates that older adults are more likely to experience deficiencies in essential nutrients, which can lead to various health complications. Consequently, there is a growing demand for supplements tailored to the needs of seniors, such as vitamin D, calcium, and B vitamins. This demographic trend is projected to increase the market size, with estimates suggesting that the aging population could contribute to a growth rate of around 5% annually in the vitamin supplements market. The focus on maintaining health and vitality in later years is likely to further drive this demand.

Growing Health Consciousness

The increasing awareness of health and wellness among consumers is a pivotal driver in the vitamin supplements market. As individuals become more informed about the benefits of vitamins and minerals, they are more inclined to incorporate these supplements into their daily routines. This trend is particularly pronounced in North America, where a survey indicated that approximately 70% of adults regularly consume dietary supplements. The focus on preventive healthcare and maintaining optimal health is likely to propel the demand for vitamin supplements. Furthermore, the rise in lifestyle-related health issues, such as obesity and diabetes, has led consumers to seek out nutritional solutions, thereby enhancing the market's growth potential. As a result, the vitamin supplements market is expected to witness sustained expansion, driven by this heightened health consciousness.

Rising Interest in Preventive Healthcare

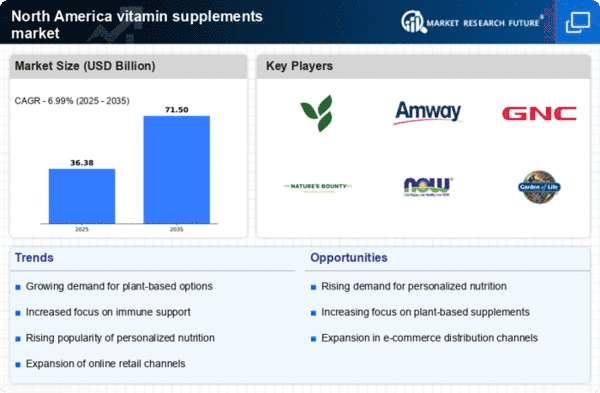

The increasing focus on preventive healthcare is a crucial driver for the vitamin supplements market. Consumers are becoming more proactive about their health, seeking ways to prevent illnesses rather than merely treating them. This shift in mindset has led to a heightened interest in dietary supplements that can support immune function, enhance energy levels, and promote overall well-being. The market is witnessing a growing demand for products that offer specific health benefits, such as immune support and stress relief. As a result, the vitamin supplements market is likely to experience robust growth, with projections indicating a compound annual growth rate (CAGR) of approximately 6% over the next five years. This trend underscores the importance of preventive measures in maintaining health and longevity.

Expansion of Retail Distribution Channels

The expansion of retail distribution channels is a significant driver in the vitamin supplements market. Traditional brick-and-mortar stores, alongside online platforms, are increasingly offering a diverse range of vitamin products, making them more accessible to consumers. Major retailers and pharmacies are expanding their supplement aisles, while health food stores are curating specialized selections. This increased availability is likely to enhance consumer convenience and encourage purchases. Additionally, the rise of subscription services for vitamin supplements is changing the landscape, providing consumers with tailored options delivered directly to their homes. This trend is expected to contribute to a projected growth rate of around 4% in the vitamin supplements market, as consumers seek both convenience and variety in their supplement choices.

Influence of Social Media and Digital Marketing

The role of social media and digital marketing in shaping consumer behavior is increasingly evident in the vitamin supplements market. Platforms such as Instagram and Facebook have become vital channels for brands to engage with consumers, promoting their products through influencers and targeted advertising. This trend has led to a surge in online sales, with e-commerce accounting for a substantial portion of the market. Data suggests that online sales of vitamin supplements in North America have grown by over 30% in recent years, reflecting a shift in purchasing habits. The ability to reach a broader audience and create personalized marketing strategies through digital platforms is likely to enhance brand visibility and consumer trust, thereby driving growth in the vitamin supplements market.