Market Trends

Key Emerging Trends in the Norway Sustainable Chemicals Market

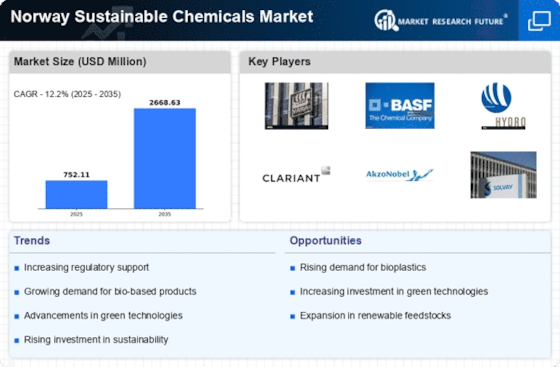

Over the past years, the market for sustainable chemicals in Norway has seen impressive growth rates as part of a wider global transition to environmental consciousness and social responsibility. Norway is highly contributing to the advancement of green options within the chemicals sector as it responds to increasing demands for sustainable solutions. Among them is bio-based products preference that are made from renewable resources. Companies are therefore working on alternative products which may replace chemical ones derived from petroleum, thus reducing their impact on nature.

‘Also, one trend in Norwegian’s sustainable chemical industry revolves around circular economy principles.’ Materials and products should be designed in such a way that minimize wastages and conserve resources through circular design principles.’ This has made Norwegian firms embrace circular economy approaches that encourage closed loop systems along with sustainable manufacturing processes.’ It should be noted as an initiative not only aimed at environmental conservation but also promoting efficiency and resilience across the entire supply chain of chemicals.

Norway’s market for green chemicals is changing fast due to environmental awareness among consumers and regulatory pressures. Today, information relating to the environment and social impacts of purchase products has become a major point of interest for customers. Consequently, enterprises are embracing sustainable certifications and labels that enable consumers easily understand how ecologically friendly the product they buy is. It is not just market forces that lead to such pattern but also Norway’s ambitious sustainability objectives including cutting down greenhouse gas emissions and facilitating a circular economy.

Alternatively, the country has witnessed huge investment into green chemistry as well as technology within its sustainable chemicals industry lately. Green chemistry refers to the process where products are designed with minimal environmental impact alongside maximum efficiency and functional performance. Additionally, utilization of green technologies such as biocatalysis or adoption of sustainable chemistry practices in this sector has been on the rise. These changes not only resonate with Norway's dedication toward environmental stewardship but also position it as an innovation center of excellence for sustainable chemical solutions.

Market trends in Norway's sustainable chemicals sector are highly influenced by collaborative efforts between entities in this industry and educational institutions. Cross-sector sharing speeds up R&D process while making sustainability-focused solutions possible at all stages of development. Public private partnerships have started to form whereby government-led programs offer incentives for innovations targeting at making green chemistry reality. Such strategy unveils new avenues towards success and resolves difficulties along the path towards sustainability.

Leave a Comment