- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

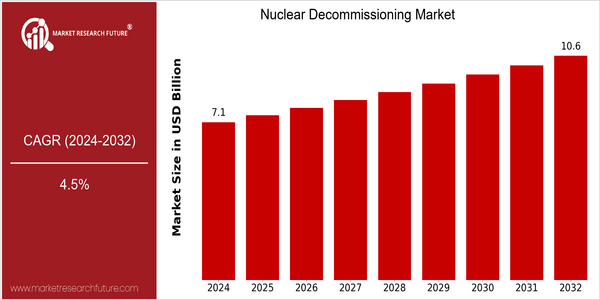

| Year | Value |

|---|---|

| 2024 | USD 7.07 Billion |

| 2032 | USD 10.55 Billion |

| CAGR (2024-2032) | 4.5 % |

Note – Market size depicts the revenue generated over the financial year

The global nuclear decommissioning market is poised for steady growth, with a current market size of USD 7.07 billion in 2024, projected to expand to USD 10.55 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of 4.5% over the forecast period. The increasing number of aging nuclear facilities and the subsequent need for safe and efficient decommissioning processes are primary drivers of this market expansion. As governments and regulatory bodies emphasize safety and environmental sustainability, the demand for advanced decommissioning technologies and services is expected to rise significantly. Technological advancements, such as robotics and remote monitoring systems, are enhancing the efficiency and safety of decommissioning operations, thereby attracting investments from key players in the industry. Companies like Areva, Westinghouse Electric Company, and Fluor Corporation are at the forefront, implementing strategic initiatives such as partnerships and innovative project launches to capitalize on this growing market. These efforts not only aim to improve operational efficiencies but also to address the complex regulatory landscape surrounding nuclear decommissioning, further solidifying their positions in this evolving sector.

Regional Market Size

Regional Deep Dive

The Nuclear Decommissioning Market is characterized by a complex interplay of regulatory frameworks, technological advancements, and public sentiment across different regions. In North America, the market is driven by aging nuclear facilities and increasing regulatory scrutiny, while Europe is focusing on sustainable decommissioning practices amid a shift towards renewable energy. The Asia-Pacific region is witnessing rapid growth due to the expansion of nuclear energy, necessitating future decommissioning strategies. Meanwhile, the Middle East and Africa are in the nascent stages of nuclear development, with decommissioning considerations becoming more relevant as projects progress. Latin America is also exploring nuclear energy, which will eventually lead to decommissioning needs as facilities age. Overall, the market dynamics are shaped by regional policies, technological innovations, and the socio-economic landscape, creating unique opportunities and challenges in each area.

Europe

- The European Union has introduced the 'Green Deal', which includes provisions for the safe and sustainable decommissioning of nuclear plants, pushing member states to adopt innovative waste management solutions.

- Countries like Germany and France are leading the way with significant investments in decommissioning technologies, with companies such as Orano and Siemens collaborating on projects that aim to minimize environmental impact.

Asia Pacific

- Japan's post-Fukushima recovery has led to a reevaluation of decommissioning strategies, with the Tokyo Electric Power Company (TEPCO) focusing on the decommissioning of the Fukushima Daiichi Nuclear Power Plant, which is expected to take decades and involves cutting-edge robotics and remote technologies.

- China is rapidly expanding its nuclear energy capacity, and as a result, the government is beginning to establish frameworks for future decommissioning, with organizations like the China National Nuclear Corporation (CNNC) taking the lead.

Latin America

- Brazil is exploring nuclear energy as part of its energy diversification strategy, and as it develops new plants, the government is beginning to consider the implications of future decommissioning, with the Brazilian Nuclear Energy Commission (CNEN) leading the discussions.

- Argentina's Atucha Nuclear Power Plant is also approaching the end of its operational life, and the government is looking into international partnerships for decommissioning expertise, highlighting the need for knowledge transfer in the region.

North America

- The U.S. Nuclear Regulatory Commission (NRC) has recently updated its decommissioning regulations, emphasizing the need for more stringent safety measures and environmental protection, which is expected to increase operational costs but enhance safety standards.

- Key players like Holtec International and EnergySolutions are actively involved in major decommissioning projects, including the dismantling of the San Onofre Nuclear Generating Station in California, showcasing advancements in decommissioning technologies.

Middle East And Africa

- The United Arab Emirates has launched its Barakah Nuclear Energy Plant, and as it becomes operational, the government is proactively developing decommissioning strategies to ensure long-term sustainability and safety.

- South Africa's Koeberg Nuclear Power Station is nearing the end of its operational life, prompting discussions on decommissioning processes and the involvement of local firms like the South African Nuclear Energy Corporation (NECSA) in planning.

Did You Know?

“Did you know that the decommissioning of a nuclear power plant can take anywhere from 10 to 60 years, depending on the size of the facility and the complexity of the decommissioning process?” — U.S. Nuclear Regulatory Commission

Segmental Market Size

The Nuclear Decommissioning Market is a critical segment focused on the safe dismantling and decommissioning of nuclear facilities, which is currently experiencing stable growth due to increasing regulatory scrutiny and aging nuclear infrastructure. Key drivers include stringent regulatory policies aimed at ensuring public safety and environmental protection, as well as the rising need for sustainable energy solutions that necessitate the responsible closure of outdated nuclear plants. Additionally, technological advancements in decommissioning methods are enhancing operational efficiency and safety, further propelling demand in this segment. Currently, the market is in a mature adoption stage, with notable examples including the decommissioning projects in the United States, such as the San Onofre Nuclear Generating Station, and in Europe, where countries like Germany and the UK are actively dismantling their nuclear facilities. Primary applications include waste management, site remediation, and environmental restoration, with companies like Areva and Westinghouse leading the charge. Trends such as government mandates for clean energy transitions and sustainability initiatives are catalyzing growth, while technologies like robotics and remote monitoring systems are shaping the future of decommissioning processes.

Future Outlook

The Nuclear Decommissioning Market is poised for significant growth from 2024 to 2032, with a projected market value increase from $7.07 billion to $10.55 billion, reflecting a compound annual growth rate (CAGR) of 4.5%. This growth trajectory is primarily driven by the increasing number of aging nuclear facilities worldwide, coupled with stringent regulatory frameworks mandating safe and efficient decommissioning processes. As governments and private entities prioritize environmental sustainability and public safety, the demand for specialized decommissioning services is expected to rise, leading to enhanced market penetration and usage rates in the sector. Key technological advancements, such as robotics and remote monitoring systems, are anticipated to revolutionize decommissioning operations, improving efficiency and safety while reducing costs. Additionally, emerging trends such as the integration of digital technologies and data analytics will enable more precise planning and execution of decommissioning projects. Policy drivers, including international agreements on nuclear safety and waste management, will further bolster the market, ensuring that decommissioning practices align with global standards. As a result, the Nuclear Decommissioning Market is set to evolve into a critical component of the broader energy transition landscape, attracting investment and innovation in the coming years.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 4.3 Billion |

| Growth Rate | 5.10% (2022-2030) |

Nuclear Decommissioning Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.