Research Methodology on Nuclear Decommissioning Market

Introduction

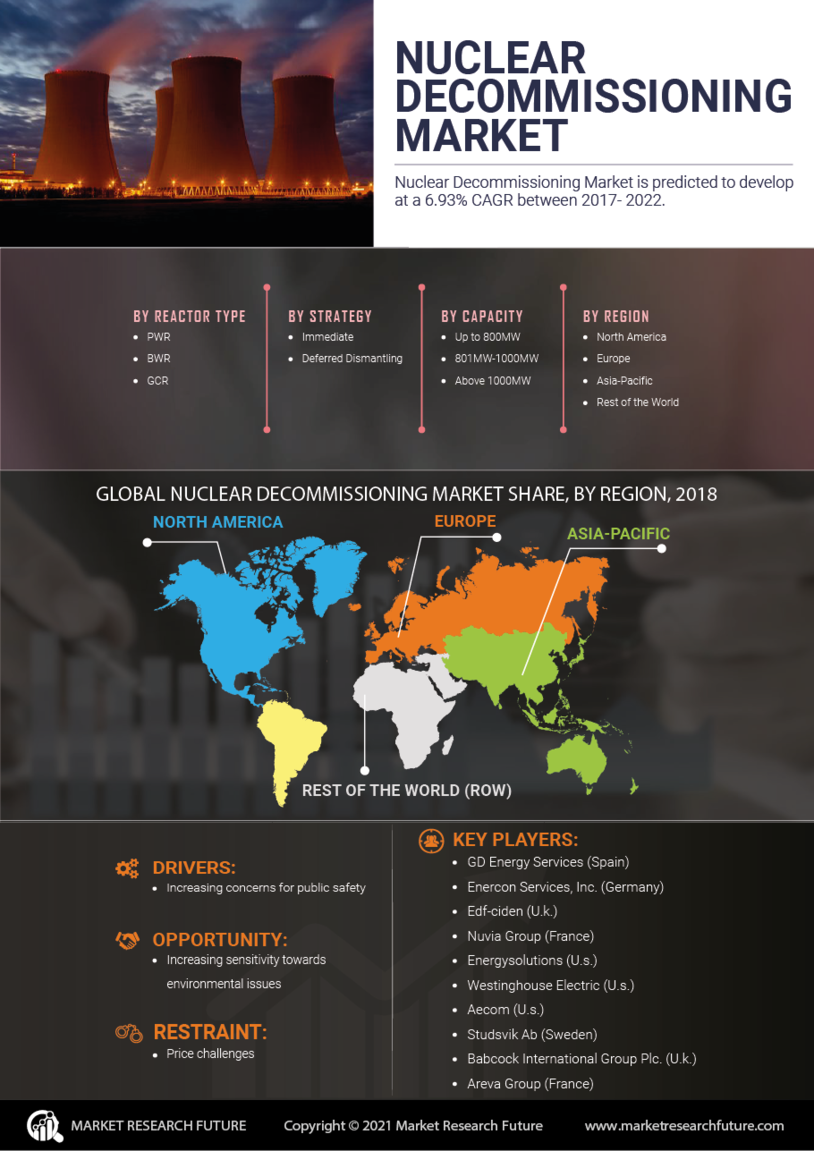

Nuclear decommissioning is the dismantling and disposal of nuclear sites, materials, components and other radioactive waste safely to stop any further nuclear activity, often to remove hazardous radiological risk. Nuclear decommissioning is usually the final stage of the process of decommissioning and decontaminating a nuclear facility. The nuclear decommissioning market is segmented into services and products, types and applications. The largest market segment is services and products, which are further divided into components and equipment. On the basis of type, the market is classified as complete and partial. In terms of application, the market is divided into shutdown, non-shutdown and others.

Research Methodology

The research for this report is conducted on a primary and secondary basis. Primary research is undertaken to examine recent trends in the nuclear decommissioning market and gather relevant information from industry experts. Extensive market surveys are conducted in the form of interviews and discussions with the help of key industry experts and primary participants in the nuclear decommissioning industry. The source of primary survey data is details like organization size, type, ownership and regulatory framework.

Secondary research is used to obtain information from various published papers and journals such as the Nuclear Decommissioning Authority (NDA), International Atomic Energy Agency (IAEA), Atomic Energy of Canada Limited (AECL) and the World Nuclear Association (WNA). These publications include the latest data and facts on the nuclear decommissioning market in terms of figures, tables, graphs, etc. The information obtained from them is used to successfully validate and analyze the data gathered from the primary resources.

Data Analysis

After collecting the information gathered through primary and secondary sources, the data needs to be analyzed and interpreted to extract useful conclusions. This analysis helps to understand the trends and outlook in the nuclear decommissioning market and helps understand the dynamics of the market such as drivers, challenges, opportunities and threats.

To draw reliable conclusions from the data and sources collected, the market players need to be closely studied. Qualitative and quantitative information related to the nuclear decommissioning market is derived from the results of the interviews conducted with various industry players. After this, consumer sentiment analysis is conducted to identify target customers in the market.

At the same time, Porter's five forces analysis is used to understand the competitive dynamics in the global nuclear decommissioning market. This helps us to determine the market attractiveness based on the parameters of supplier power, the threat of new entrants, customer power, the threat of substitutes and competitive rivalry. This analysis also helps to identify trends, organization size and operations in the market.

In addition, the market is segmented based on types and applications to understand the market structure more deeply. Furthermore, to have a more accurate figure of the size of the nuclear decommissioning market, the market is estimated for both top-down and bottom-up approaches. This helps to have a more concrete figure of the actual size of the market.

Conclusion

This research is conducted to identify the various trends and market outlooks of the global nuclear decommissioning market. Through primary and secondary research, as well as analysis of the results of the qualitative and quantitative data collected, it is possible to assess the competitive dynamics in this market and understand the target customer base in the market. Additionally, Porter's five forces analysis and market segmentation have helped to determine the competition and structure of the market and estimate the actual size of the market using top-down and bottom-up approaches.