Offshore Decommissioning Market Summary

As per Market Research Future analysis, the Offshore Decommissioning Market Size was estimated at 6.1 USD Billion in 2024. The Offshore Decommissioning industry is projected to grow from 6.533 USD Billion in 2025 to 12.97 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Offshore Decommissioning Market is poised for growth driven by sustainability and technological advancements.

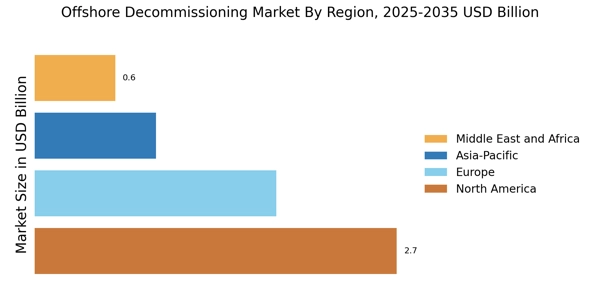

- North America remains the largest market for offshore decommissioning, reflecting a robust regulatory framework and aging infrastructure.

- The Asia-Pacific region is emerging as the fastest-growing market, propelled by increasing offshore activities and economic development.

- Well Plugging and Abandonment is the largest segment, while Platform Preparation is witnessing rapid growth due to heightened environmental awareness.

- Key market drivers include regulatory compliance and the economic viability of decommissioning, which are shaping industry practices.

Market Size & Forecast

| 2024 Market Size | 6.1 (USD Billion) |

| 2035 Market Size | 12.97 (USD Billion) |

| CAGR (2025 - 2035) | 7.1% |

Major Players

Halliburton (US), Schlumberger (US), Baker Hughes (US), TechnipFMC (GB), Saipem (IT), Wood Group (GB), Decom North Sea (GB), Petrofac (GB), Aker Solutions (NO)