Market Growth Projections

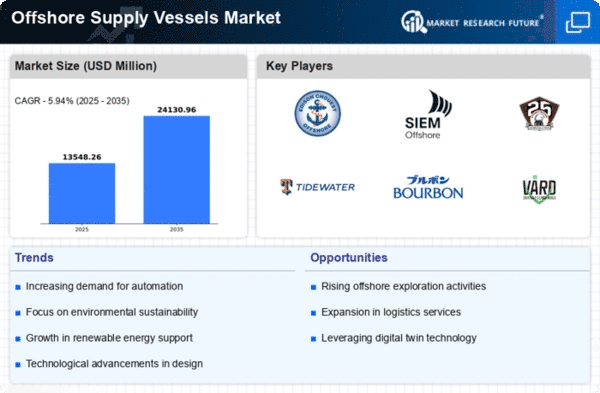

The Global Offshore Supply Vessels Market Industry is poised for substantial growth, with projections indicating a market value of 12.8 USD Billion in 2024 and an anticipated increase to 24.1 USD Billion by 2035. The compound annual growth rate is expected to be 5.94% from 2025 to 2035, reflecting the industry's resilience and adaptability to changing market dynamics. This growth trajectory is influenced by various factors, including technological advancements, regulatory support, and increasing demand for offshore energy solutions.

Increasing Demand for Renewable Energy

The Global Offshore Supply Vessels Market Industry is experiencing a notable surge in demand due to the increasing focus on renewable energy sources, particularly offshore wind farms. Governments worldwide are investing heavily in renewable energy projects, which necessitate the use of specialized vessels for the transportation of equipment and personnel. For instance, the European Union aims to generate 300 GW of offshore wind energy by 2030, driving the need for offshore supply vessels. This trend is expected to contribute significantly to the market's growth, with projections indicating a market value of 12.8 USD Billion in 2024 and a potential rise to 24.1 USD Billion by 2035.

Regulatory Support for Maritime Operations

Regulatory frameworks supporting maritime operations are playing a crucial role in shaping the Global Offshore Supply Vessels Market Industry. Governments are implementing policies that promote safe and efficient maritime practices, which in turn encourages investment in offshore supply vessels. For instance, the International Maritime Organization has established guidelines aimed at reducing greenhouse gas emissions from shipping, prompting vessel operators to upgrade their fleets. This regulatory support not only enhances operational safety but also aligns with global sustainability objectives, fostering a conducive environment for market growth.

Technological Advancements in Vessel Design

Technological innovations in vessel design and construction are propelling the Global Offshore Supply Vessels Market Industry forward. Enhanced vessel capabilities, such as dynamic positioning systems and improved fuel efficiency, are becoming increasingly prevalent. These advancements not only optimize operational efficiency but also reduce environmental impact, aligning with global sustainability goals. For example, the introduction of hybrid vessels is expected to lower emissions significantly. As the industry embraces these technologies, it is likely to attract more investments, thereby supporting the anticipated compound annual growth rate of 5.94% from 2025 to 2035.

Expansion of Offshore Oil and Gas Exploration

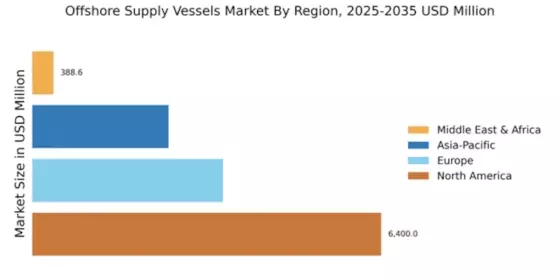

The Global Offshore Supply Vessels Market Industry is significantly influenced by the expansion of offshore oil and gas exploration activities. As energy demands continue to rise, companies are increasingly investing in offshore drilling projects, particularly in regions such as the Gulf of Mexico and the North Sea. This expansion necessitates a robust supply chain, including offshore supply vessels for logistics and support. The International Energy Agency projects that offshore oil production will account for a substantial portion of global oil supply, further driving the demand for specialized vessels in this sector.

Rising Investment in Infrastructure Development

The Global Offshore Supply Vessels Market Industry is benefiting from rising investments in infrastructure development, particularly in coastal regions. Governments and private entities are increasingly funding projects that require offshore supply vessels for construction and maintenance. For example, the development of ports and marine terminals necessitates the use of specialized vessels for transporting materials and personnel. This trend is expected to bolster the market, as infrastructure projects are projected to increase significantly in the coming years, creating a steady demand for offshore supply vessels.