Rising Demand for Renewable Energy Support

The Platform Supply Vessels PSV Market is also being driven by the rising demand for support in renewable energy projects, particularly offshore wind farms. As countries strive to transition to cleaner energy sources, the need for specialized vessels to transport equipment and personnel to offshore wind installations is increasing. The offshore wind sector is projected to grow significantly, with investments expected to reach billions in the coming years. This growth necessitates the use of PSVs that can efficiently service these renewable energy projects. The versatility of PSVs in adapting to various operational requirements makes them indispensable in the renewable energy landscape. Consequently, the increasing focus on renewable energy is likely to bolster the Platform Supply Vessels PSV Market, creating new opportunities for vessel operators and manufacturers.

Technological Innovations in Vessel Design

Technological advancements in vessel design are transforming the Platform Supply Vessels PSV Market. Innovations such as enhanced fuel efficiency, improved cargo capacity, and advanced navigation systems are becoming increasingly prevalent. These developments not only reduce operational costs but also enhance the safety and reliability of PSVs. For instance, the introduction of dynamic positioning systems allows vessels to maintain their position with precision, which is essential in challenging offshore environments. Furthermore, the integration of automation and digital technologies is streamlining operations, making PSVs more efficient. As the industry embraces these innovations, it is anticipated that the demand for technologically advanced PSVs will rise, thereby propelling the growth of the Platform Supply Vessels PSV Market. The focus on modernization is likely to attract investments and foster competition among vessel manufacturers.

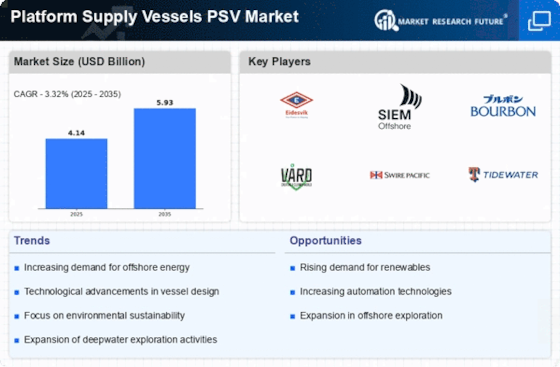

Increasing Offshore Oil and Gas Exploration

The Platform Supply Vessels PSV Market is experiencing a notable surge due to the increasing offshore oil and gas exploration activities. As energy demands rise, companies are investing in new offshore projects, necessitating the use of PSVs for efficient transportation of supplies and personnel. According to recent data, the offshore oil and gas sector is projected to grow at a compound annual growth rate of approximately 5% over the next five years. This growth is likely to drive demand for PSVs, as they play a crucial role in supporting drilling operations and maintaining supply chains. The need for reliable and efficient vessels is paramount, as operators seek to optimize their logistics and reduce operational costs. Consequently, the expansion of offshore exploration is a significant driver for the Platform Supply Vessels PSV Market.

Geopolitical Tensions and Supply Chain Resilience

Geopolitical tensions are emerging as a critical driver for the Platform Supply Vessels PSV Market. As nations navigate complex international relations, the need for secure and resilient supply chains becomes paramount. Offshore operations are often affected by geopolitical dynamics, leading to increased demand for PSVs that can operate in diverse and potentially volatile environments. Companies are seeking to enhance their supply chain resilience by investing in reliable vessels capable of navigating geopolitical uncertainties. This trend is likely to result in a shift in procurement strategies, with operators prioritizing PSVs that offer flexibility and adaptability. As geopolitical factors continue to shape the energy landscape, the Platform Supply Vessels PSV Market is expected to evolve, reflecting the changing dynamics of global supply chains.

Regulatory Compliance and Environmental Standards

The Platform Supply Vessels PSV Market is significantly influenced by regulatory compliance and environmental standards. Governments and international bodies are increasingly imposing stringent regulations aimed at reducing the environmental impact of offshore operations. This has led to a heightened demand for PSVs that meet these evolving standards. Vessels equipped with eco-friendly technologies, such as hybrid propulsion systems and waste management solutions, are becoming essential for operators seeking to comply with regulations. The market is witnessing a shift towards greener vessels, which not only align with regulatory requirements but also appeal to environmentally conscious stakeholders. As a result, the emphasis on compliance and sustainability is likely to drive innovation and investment in the Platform Supply Vessels PSV Market, fostering a more sustainable operational framework.