Adoption of Real-Time Bidding

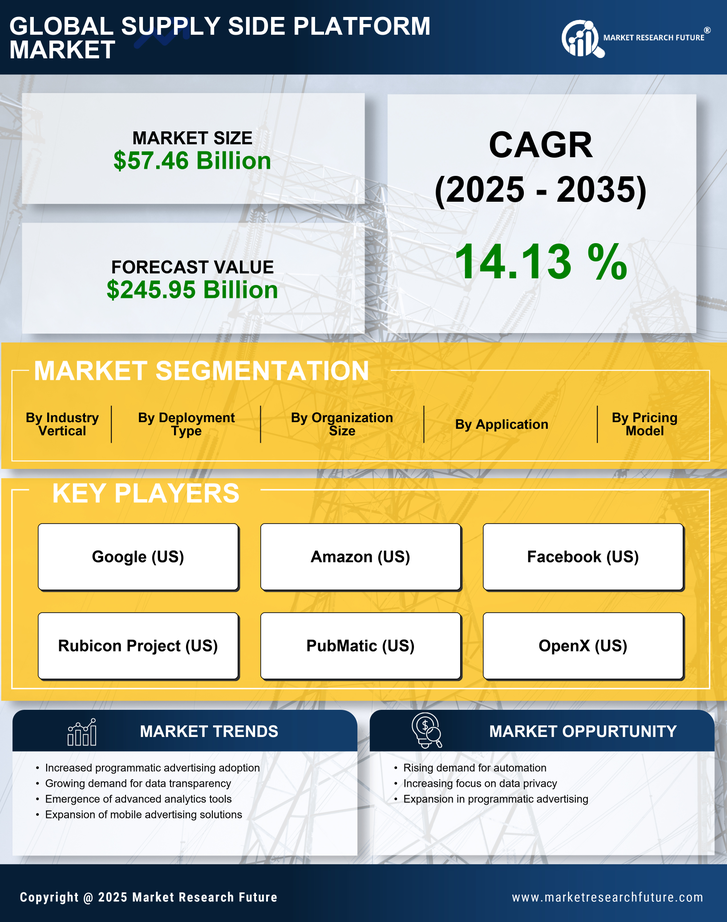

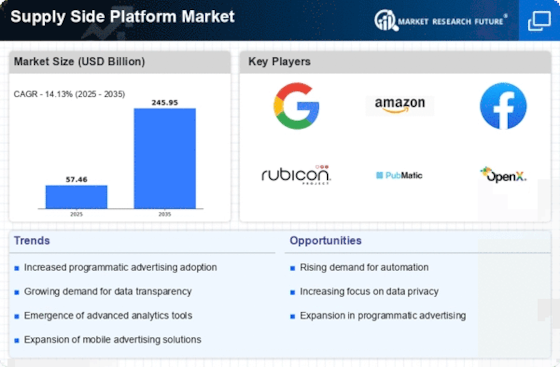

Real-time bidding (RTB) is revolutionizing the Supply Side Platform Market by enabling instantaneous ad transactions. This technology allows advertisers to bid on ad impressions in real-time, ensuring that the most relevant ads are displayed to users. As of 2025, it is anticipated that RTB will account for a significant portion of digital ad spending, with estimates suggesting it could reach 300 billion USD. The efficiency and effectiveness of RTB are appealing to both advertisers and publishers, as it maximizes revenue potential while minimizing wasted ad spend. Consequently, the Supply Side Platform Market is likely to see increased investment in RTB technologies, further enhancing the competitive landscape and driving innovation in ad delivery mechanisms.

Emergence of Mobile Advertising

The proliferation of mobile devices has significantly influenced the Supply Side Platform Market. With mobile advertising projected to account for over 70% of total digital ad spending by 2025, platforms that cater to mobile inventory are becoming increasingly vital. This trend is driven by the growing number of mobile users and their preference for consuming content on smartphones and tablets. As a result, Supply Side Platforms are adapting their technologies to optimize mobile ad delivery, ensuring that publishers can effectively monetize their mobile traffic. The emphasis on mobile-first strategies indicates that the Supply Side Platform Market is likely to evolve rapidly, with a focus on enhancing user experience and engagement through mobile advertising solutions.

Growing Importance of Data Analytics

Data analytics plays a crucial role in the Supply Side Platform Market, as it enables publishers to make informed decisions regarding ad placements and inventory management. The integration of advanced analytics tools allows for better understanding of audience behavior, leading to more effective targeting strategies. In 2025, the market for data analytics in advertising is projected to exceed 100 billion USD, highlighting its significance in driving revenue growth. As publishers seek to leverage data for optimizing their ad strategies, Supply Side Platforms that offer robust analytics capabilities are likely to gain a competitive edge. This trend underscores the necessity for continuous innovation in data-driven solutions within the Supply Side Platform Market.

Rising Demand for Digital Advertising

The Supply Side Platform Market is experiencing a notable surge in demand for digital advertising solutions. As businesses increasingly shift their marketing budgets from traditional media to digital channels, the need for efficient ad inventory management becomes paramount. In 2025, it is estimated that digital advertising expenditures will surpass 500 billion USD, indicating a robust growth trajectory. This shift is driven by the desire for targeted advertising, which enhances return on investment. Consequently, Supply Side Platforms are positioned to capitalize on this trend by offering tools that optimize ad placements and maximize revenue for publishers. The increasing reliance on digital channels suggests that the Supply Side Platform Market will continue to expand as advertisers seek innovative ways to reach their audiences.

Regulatory Compliance and Data Privacy

The increasing focus on regulatory compliance and data privacy is shaping the Supply Side Platform Market. With regulations such as GDPR and CCPA influencing how data is collected and utilized, platforms must adapt to ensure compliance while maintaining effective advertising strategies. As of 2025, it is expected that companies investing in compliance solutions will see a rise in consumer trust, which is essential for successful ad campaigns. This shift necessitates that Supply Side Platforms implement transparent data practices and robust security measures. The emphasis on data privacy not only protects consumers but also enhances the credibility of the Supply Side Platform Market, potentially leading to increased adoption of compliant advertising solutions.