Naval Combat Vessels Market

ABSTRACT

The purpose of this research methodology is to study the global naval combat vessels market. The analysis will employ primary and secondary research methodologies to provide a comprehensive overview of the market. Bottom-up and top-down approaches, factor analysis, time-series analysis and demand side/supply side data triangulation will be used to arrive at detailed market insights and understand the driving and restraining factors of the market.

INTRODUCTION

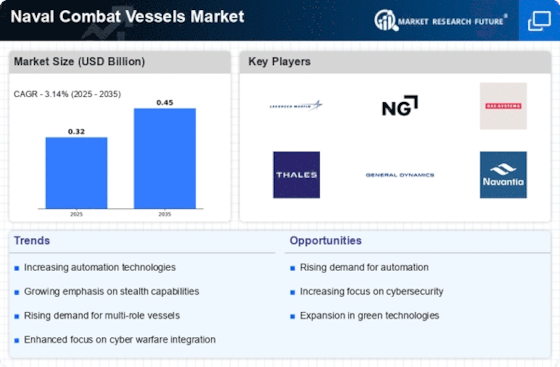

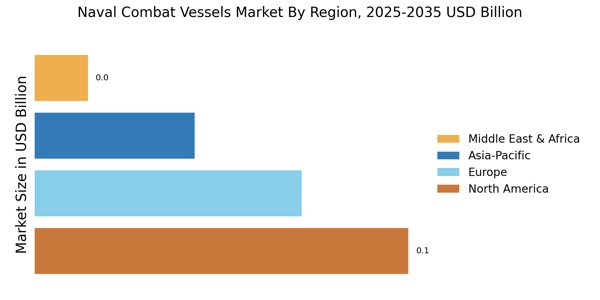

The global naval combat vessels market is estimated to rise continuously in upcoming years. According to the Market Research Future (MRFR) report, the global naval combat vessels market is predicted to grow at a steady pace over the forecast period of 2023-2030. Factors like increasing political tensions among nations are driving the market growth and technological developments in naval warfare vessels are providing impetus to the market. The analysis of the report will aim to provide a comprehensive overview of the global naval combat vessels market cover the market drivers and restraints and anticipate the market growth.

RESEARCH METHODOLOGY

In order to provide a comprehensive view of the global naval combat vessels market, a variety of research methods have been employed. Primary and secondary research techniques stemming from the bottom-up and top-down approaches have been employed to provide detailed market estimates and the competitive landscape.

SECONDARY RESEARCH

Secondary research was conducted to gain a better understanding of the naval combat vessels market. Secondary research mainly included the use of a variety of paid and unpaid resources including company websites, company profiles, press releases, and magazine articles. Traditional resources including data from previous years, annual cutbacks, and capital expenditure were used in this study. The information obtained from these resources was studied to understand the potential growth of the naval combat vessels market.

PRIMARY RESEARCH

In order to validate the data obtained through secondary research, data from various primary sources was also collected. This includes interviews conducted with key stakeholders in the industry, OEMs and key market players in naval combat vessels. These interviews were conducted by taking direct feedback from senior executives, regional managers, VPs, department heads, and engineering leaders.

FACTOR ANALYSIS

In this segment of the study, various models of factor analysis have been used to analyze current and upcoming market trends, customer preference and behaviour, growth opportunities and competitive landscapes. Factor analysis includes both traditional as well as modern statistical techniques such as correlation analysis, cluster analysis, factor analysis, satisfaction analysis, attitudinal analysis, and regression analysis.

TIME-SERIES ANALYSIS

Time-series analysis is the overall study of past trends in the overall market. Time-series analysis helps in predicting the future trends in the market. It is used to identify the erratic behaviour found in the data and analyze the impact of different external factors on the dynamic of the market.

DEMAND-SIDE AND SUPPLY-SIDE DATA TRIANGULATION

Demand-side and supply-side data triangulation is a process of forming a comprehensive picture of market size and trends by combining primary and secondary sources of data. The demand-side data is primarily based on the actual end-user demand in the market. On the other hand, the supply-side data is based on the assessment of production and sales of naval combat vessels and other information of interest identified in the secondary research.

CONCLUSION

In conclusion, an analysis of the global naval combat vessels market has been conducted and the study indicates a positive growth trajectory. Primary and secondary research based on the bottom-up and top-down approaches along with factor analysis, time-series analysis and demand-side/supply-side data triangulation have been employed to study the market extensively. We believe that this research will help players in the naval combat vessels market devise strategies based on the trends identified and capitalize on the market opportunities.