Market Share

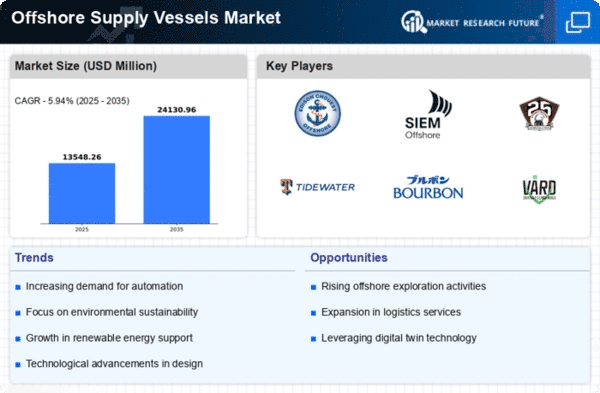

Introduction: Navigating the Future of Offshore Supply Vessels

OFFSHORE SUPORT VESSELS MARKET OPERATING IN THE OFFSHORE AREAS OF THE WORLD IS NOW A MARKET WITH INTENSIVE COMPETITIVE FORCES, AFFECTED BY CHANGES IN REGULATIONS, TECHNOLOGY AND OPERATING PRACTICES, AND BY CHANGES IN CONSUMER PERSPECTIVE. In this market, the main players, such as the original equipment manufacturers (OEMs), IT system integrators and green energy suppliers, are striving to take the lead by deploying advanced technology such as artificial intelligence (AI), automation and IoT. These innovations not only increase the operational efficiency of the companies but also change the way services are provided, thus helping them to meet the stricter regulatory requirements and the growing demand for eco-friendly solutions. In the regional markets, especially in Asia-Pacific and Europe, the trend is towards deploying more biometrics and green technology. The offshore supply vessels market is a very complex one, and the companies operating in it need to be well aware of the current market trends and the competitive environment to be able to respond effectively to the challenges.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions across various offshore supply vessel needs, integrating multiple services and technologies.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| A.P. Moller - Maersk AS | Global leader with extensive fleet | Integrated offshore logistics | Global |

| Tidewater | Strong operational footprint in key markets | Diverse offshore support services | Americas, Europe, Africa |

| SEACOR Marine | Versatile fleet for various applications | Offshore marine services | Global |

Specialized Technology Vendors

These vendors focus on niche technologies and solutions tailored for specific offshore supply vessel applications.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Bourbon Offshore | Innovative vessel designs and operations | Specialized offshore support | Global |

| Havila Shipping | Sustainability-focused operations | Environmentally friendly vessels | Europe, North Sea |

Infrastructure & Equipment Providers

These vendors supply essential equipment and infrastructure necessary for the operation of offshore supply vessels.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Siem Offshore AS | Robust engineering capabilities | Marine equipment and services | North Sea, Brazil |

| Solstad Farstad | Strong focus on advanced technology | Offshore construction and support | Global |

| Edison Chouest Offshore | Comprehensive logistics and support | Integrated offshore services | Gulf of Mexico, International |

| Vroon B. V. | Diverse fleet with global reach | Marine services and logistics | Global |

| Abdon Callais Offshore LLC | Local expertise in Gulf operations | Offshore supply and support | Gulf of Mexico |

Emerging Players & Regional Champions

- SEACO MARINE HOLDINGS (USA): specializes in the provision of offshore supply vessels, crewboats and platform supply vessels. Recently, the company has been awarded a multi-year contract in the Gulf of Mexico with a major oil company, which will significantly increase its market share. The company’s green-friendly vessels are a challenge to the established players.

- Norway - Vard Group: Innovative concepts for offshore support vessels, especially for the wind power industry. Delivered a series of vessels for wind farm service operations in Europe. Their expertise in hybrid and electrical propulsion makes them a strong competitor for traditional shipyards.

- Bourbon Offshore (France): This company specializes in the provision of integrated maritime services and has recently expanded its fleet with advanced offshore support vessels adapted to deepwater operations. Strategic alliances with local African operators have increased the company's influence in the region and posed a challenge to established players in the area.

- The Eastern Shipbuilding Group, based in the United States, is known for building offshore support vessels for the U.S. Coast Guard and commercial operators. But they’ve also just launched a new class of vessels, designed to be more fuel-efficient, which could shake up the market and set a new standard for operating costs.

Regional Trends: In 2024, the trend towards hybrid and electric vessels is marked, particularly in Europe and North America, by the imposition of regulatory measures and by the demands of the environment. The demand for special vessels for offshore wind farms and for deep-sea oil drilling is growing, and there is a rise in regional champions specializing in these niche markets. Strategic alliances are also formed between companies to strengthen the offer and to increase the geographical scope of their activities.

Collaborations & M&A Movements

- Siem Offshore and DOF Subsea entered into a partnership to enhance their operational capabilities in the North Sea, aiming to increase market share in the growing renewable energy sector.

- Bourbon Offshore acquired a fleet of five modern supply vessels from Tidewater in early 2024, strengthening its position in the Gulf of Mexico and expanding its service offerings.

- Maersk Supply Service and Ørsted announced a collaboration to provide integrated offshore logistics solutions for wind farm projects, positioning themselves as leaders in the renewable energy supply chain.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Biometric Self-Boarding | Damen Shipyards, Boskalis | Damen Shipyards has implemented biometric self-boarding systems in their vessels, enhancing security and efficiency. Boskalis has adopted similar technologies, showcasing a commitment to modernizing operations and improving passenger flow. |

| AI-Powered Ops Mgmt | Siemens, Kongsberg | The ship’s route and fuel consumption are calculated by means of a system developed by Siemens. The advanced artificial intelligence systems from Kongsberg have been used successfully in several offshore projects, and they have contributed to significant operational improvements. |

| Border Control | Thales Group, Raytheon | Thales Group provides advanced border control solutions that enhance security for offshore operations. Raytheon's systems are widely recognized for their reliability and integration with existing maritime security frameworks. |

| Sustainability | Maersk Supply Service, Eidesvik Offshore | Maersk Supply Service has made significant strides in sustainability by utilizing hybrid vessels and reducing emissions. Eidesvik Offshore is known for its commitment to green technologies, including LNG-powered vessels, setting industry benchmarks. |

| Passenger Experience | Vard Group, Fincantieri | Vard Group focuses on enhancing passenger experience through innovative design and comfort features in their vessels. Fincantieri has a strong reputation for luxury and passenger-centric designs, catering to high-end offshore tourism. |

Conclusion: Navigating Competitive Waters in 2024

The market for offshore supply vessels is highly competitive and fragmented, with both established and new entrants competing for market share. Regional trends point to a shift towards sustainable practices and advanced technology, which will require suppliers to adapt their strategies accordingly. As the market matures, established companies are looking to leverage their existing knowledge and networks to stay ahead of the game, while newcomers are focusing on innovation, especially in the fields of automation and artificial intelligence. To remain competitive, companies will need to focus on integrating a sustainable and flexible approach into their operations. Strategic decision-makers will have to navigate these complexities and prioritise investment in cutting-edge capabilities to stay ahead of the game and meet the demands of a rapidly changing market.

Leave a Comment