Research Methodology on Nutraceuticals Market

Introduction

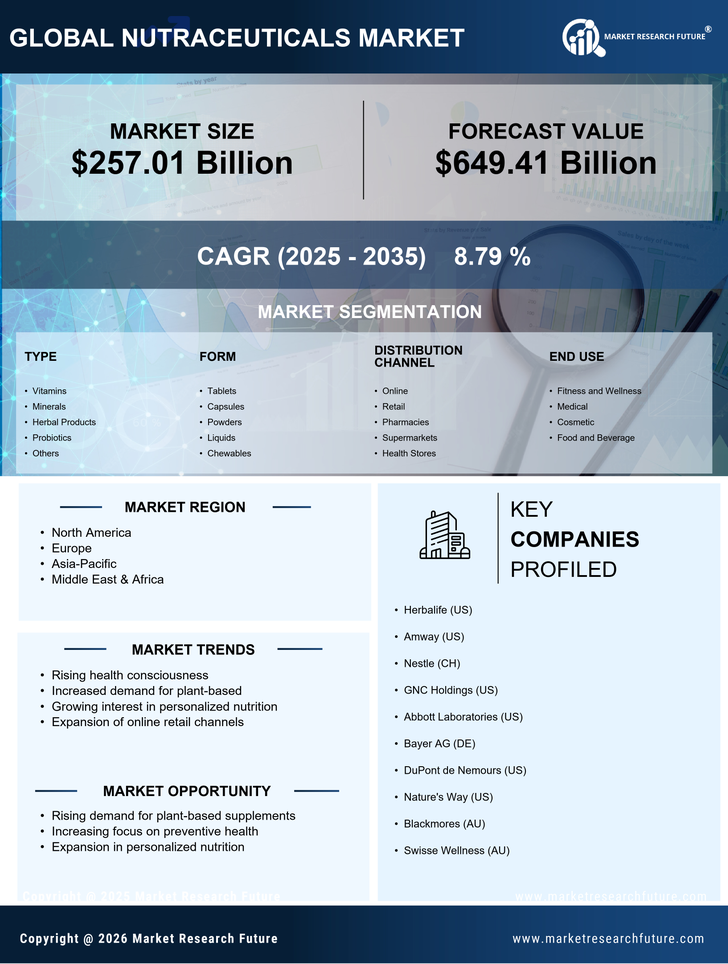

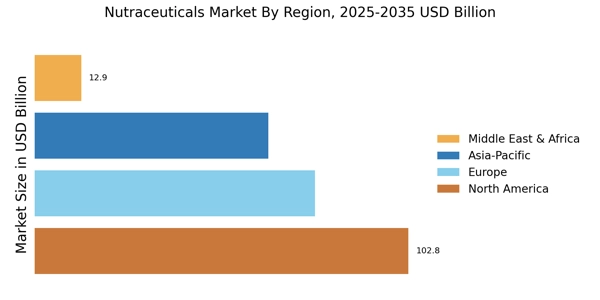

The nutraceuticals market is growing steadily and is expected to grow further in the coming years. It is estimated that the global nutraceuticals market will reach an all-time high revenue by 2030. The increase in demand for nutraceuticals is mainly driven by increasing awareness about the importance of regular nutritional supplement intake, as well as the growing demand for functional foods and beverages, among other factors.

What is a nutraceutical?

It is a combination of nutrition and pharmaceuticals and refers to a food or food product that provides medical benefits and health benefits that go beyond just providing nutrition, vitamins and minerals.

This research methodology explores the following research question, “What are the factors driving the growth of the nutraceuticals market?” to gain insights into the market dynamics of the nutraceuticals sector. The research methodology includes a review of existing secondary sources of information, such as market studies, and also involves interviews and surveys of relevant stakeholders to collect primary information.

Objectives

- To provide an overview of the nutraceuticals market.

- To study the growth drivers and trends in the nutraceuticals market.

- To assess consumer behaviour and preferences when it comes to nutraceuticals.

- To analyse industry experts’ views on the potentials and opportunities of the nutraceuticals market.

Literature Review

The literature review for this research report includes an extensive review of secondary sources such as market studies, reports and journals related to nutraceuticals. This enables the researcher to gain an understanding of the global nutraceuticals market and its dynamics. As part of the research, the researchers also conduct a review of industry experts opinions on the potential and opportunities of the nutraceuticals market.

Research Design

The researchers utilized a combination of qualitative and quantitative research designs to gain insights into the factors driving the growth of the nutraceuticals market. The research involves a combination of surveys, interviews and focus groups, as well as data collection and analysis.

Data Collection Method

The primary data for this research project is collected through interviews and surveys of relevant stakeholders. The interviewees include industry experts, nutraceuticals manufacturers, industry associations, distributors and retailers.

Analysis Method

The collected data is analysed using a combination of techniques such as trend analysis, content analysis, case study analysis and interpretative analysis and the results of the analysis are presented in a report.

Sampling

The sample for this research project includes a sample of 300 customers, 100 experts in the nutraceuticals industry, 20 nutraceuticals manufacturers, 20 industry associations, 20 distributors and 20 retailers.

Timeline

The research project is completed within 12 weeks, with the following timeline:

- Week 1: Developing the research proposal and methodology

- Week 2: Data collection (surveys, interviews, focus groups)

- Week 3: Analyzing collected data

- Week 4: Preparing the report

- Week 5 – 9: Revising the report and presenting results

- Week 10: Finalizing the report

- Week 11: Print and present the report

- Week 12: Follow-up and review

Conclusion

This research methodology will help provide insights into the factors driving the growth of the nutraceuticals market, allowing the researcher to identify opportunities and potentials within the market. The methodology outlined in this research report enables the researchers to collect and analyse the necessary data to answer the research question, ‘what are the factors driving the growth of the nutraceuticals market?’.