Market Analysis

In-depth Analysis of Obstructive Lung Disease Market Industry Landscape

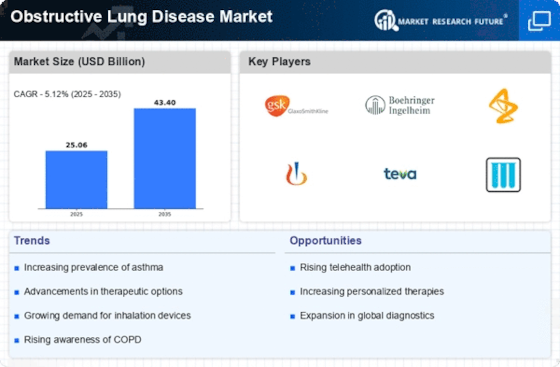

The Obstructive Lung Disease Market has several factors, which makes it dynamic with multiple influences on its dynamics and growth. A significant driver for this market is the increasing prevalence of obstructive lung diseases, including chronic obstructive pulmonary disease (COPD) and asthma. Factors like smoking, environmental pollutants, and genetic predisposition contribute to increased incidence rates for such diseases leading to high demand for effective treatment options and management solutions. Medical research progressions alongside technology are among the key determinants that shape the path into obstructive lung disease market. Ongoing studies seek to deepen our understanding on how these conditions occur in order to discover new ways of treating them. The identification of new treatment alternatives combined with incorporation of modern technologies creates a larger market thus equipping healthcare professionals with better tools for managing and treating these diseases. Factors that guide the commercialization and development process include regulatory issues related to obstruction lung conditions’ therapy. Products used in treatments under this condition have very strict regulation laws regarding their safety and efficiency making it a requirement for local healthcare providers to be convinced about their benefits as well before recommending them. Adherence therefore becomes an aspect that differentiates between firms offering similar products but operating within different countries depending on how they follow regulations set by governing bodies within those areas. Another critical market factor is the competitive landscape among pharmaceutical companies. With this, there is intense rivalry that promotes innovation as these firms try to develop better remedies for obstructive lung diseases to outdo their rivals. The other aspect of the competition environment in this industry is that companies engage in strategic collaborations, mergers, and acquisitions to expand their product portfolios and move into a wider section of the obstructive lung disease market. Thus, well-executed marketing and differentiation of therapies are crucial for success here. Additionally, consumer preferences as well as changing healthcare trends also influence the obstructive lung disease market. Product development and marketing strategies are guided by patient preference for convenient inhalation devices as well as personalized medicine and biologics. In response to these preferences, companies’ focus has shifted towards patients resulting in an increase in patient centered approaches aimed at developing treatments that address current healthcare trends.

Leave a Comment