Top Industry Leaders in the Off-road Electric Vehicles Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Off Road Electric Vehicles industry are:

Narrow Isle Inc.

Komatsu Ltd.

Epiroc

Toyota Motor Corporation

Cargotec corporation

LIEBHERR-International Deutschland GmbH

JCB

AB Volvo

Anhui Heli Co., Ltd.

Caterpillar

Hyundai Doosan Infracore Co. Ltd.

Sandvik

SANY Group

Hitachi Construction Machinery

DEERE & COMPANY

Clark

CNH Industrial

Bridging the Gap by Exploring the Competitive Landscape of the Off Road Electric Vehicles Top Players

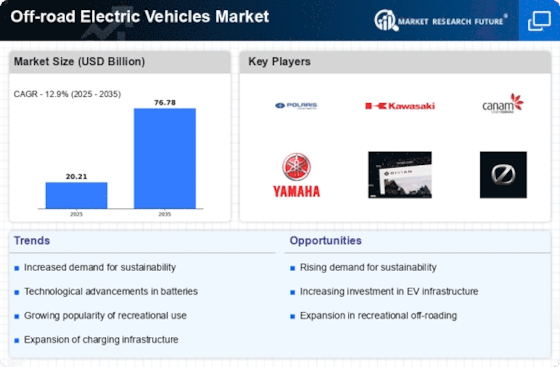

The off-road electric vehicle (OEV) market is revving up, fueled by environmental concerns, technological advancements, and a growing appetite for adventure among consumers. This nascent market promises dynamic competition, with established players adapting their strategies and new entrants pushing boundaries. Here's a look at the current landscape:

Key Players and Their Strategies:

Traditional Automakers: Giants like Ford, General Motors, and Toyota are leveraging their legacy and vast resources to develop electric trucks and SUVs with off-road capabilities. Ford's F-150 Lightning and Rivian's R1T are prime examples, showcasing impressive specs and capturing early adopter interest.

Established Off-Road Brands: Polaris, known for its ATVs and side-by-sides, is electrifying its offerings with models like the RZR Pro R PEV. Likewise, Jeep's Wrangler BEV concept demonstrates their commitment to this growing segment. These brands capitalize on their existing off-road expertise and loyal customer base.

New EV Startups: Rivian, Lordstown Motors, and Canoo are disrupting the scene with innovative designs and a focus on pure electric platforms. Rivian's skateboard architecture offers flexibility and scalability, while Lordstown Motors targets commercial fleets with their Endurance pickup truck. These startups bring fresh perspectives and agility to the market.

Factors for Market Share Analysis:

Range and Performance: OEVs face range limitations compared to gas-powered counterparts. Players focused on increasing range and off-road performance, like Rivian's 300+ mile range and Ford's one-pedal driving mode, hold an advantage.

Charging Infrastructure: The lack of widespread charging infrastructure, especially in remote areas, remains a hurdle. Companies partnering with charging networks or developing innovative solutions, like Ford's "Charge Station Pro," will gain traction.

Price and Affordability: OEVs currently carry a premium price tag. Strategies focused on cost reduction, targeted at specific consumer segments, and innovative financing options will be crucial for wider adoption.

Emerging Trends Shaping the Market:

Electrification of Utility Vehicles: Electric versions of ATVs, UTVs, and snowmobiles are gaining momentum. Polaris' General EV and Zero Motorcycles' FX electric motorcycle cater to diverse recreational needs.

Focus on Commercial Applications: OEVs offer significant environmental and efficiency benefits for mining, construction, and agriculture. Komatsu's battery-powered dump trucks and John Deere's electric tractors exemplify this trend.

Customization and Personalization: Companies are exploring modular platforms and digital interfaces to allow users to tailor their OEVs for specific adventures and tasks. Canoo's modular interior and Rivian's Gear Tunnel storage system are examples of this trend.

Overall Competitive Scenario:

The OEV market is a hotbed of innovation and disruption. While established players hold initial brand recognition and resources, startups offer flexibility and fresh ideas. Success will hinge on balancing range, performance, and affordability with strategic partnerships and catering to diverse segments. Adaptability, technological prowess, and a commitment to sustainability will be key differentiators in this electric off-road race.

This snapshot of the OEV market highlights its dynamism and exciting potential. As the technology matures and infrastructure improves, expect even more players to enter the fray, further intensifying the competition and paving the way for a thrilling electric off-road future.

Latest Company Updates:

Narrow Isle Inc.

- November 2023: Narrow Isle unveils its next-generation electric forklift, the N3, boasting greater range and improved performance (Narrow Isle press release).

Komatsu Ltd.

- December 2023: Launches the ZE26 excavator, its first commercially available battery-powered excavator (Komatsu press release).

Epiroc:

- October 2023: Introduces the Boomer E2 battery-powered underground mining loader (Epiroc website).

Toyota Motor Corporation:

- January 2024: Reports it's considering entering the off-road electric vehicle market with a pickup truck model (Nikkei Asia, January 2024).

Cargotec corporation

- December 2023: Acquires Kalmar Automation Solutions, strengthening its position in electric terminal tractors (Cargotec press release).