- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

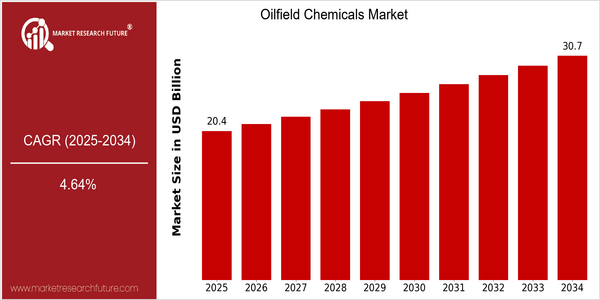

| Year | Value |

|---|---|

| 2025 | USD 20.41 Billion |

| 2034 | USD 30.7 Billion |

| CAGR (2025-2034) | 4.64 % |

Note – Market size depicts the revenue generated over the financial year

Oilfield chemicals are a growing market. It is expected to reach $ 20.41 billion by 2025 and to rise to $ 30.7 billion by 2034. This is an increase of 4.64% CAGR over the forecast period. The market growth is due to a number of key factors, including the increasing demand for enhanced oil recovery, the increasing complexity of oilfield operations, and the growing focus on the use of environmentally friendly chemicals. The demand for advanced oilfield chemicals is growing because of the need for improved production and reduced costs. The market is also being driven by the development of smart chemicals and biochemicals. These innovations not only enhance efficiency but also support the industry’s move towards a more sustainable future. Halliburton, Schlumberger and BASF are investing in research and development to develop more efficient and eco-friendly products. Strategic alliances and collaborations are also a key feature of the highly competitive market.

Regional Market Size

Regional Deep Dive

The Oilfield chemicals market is growing rapidly across the world. It is driven by increasing exploration and production activities, technological advancements, and rising focus on sustainable practices. Each region has its own characteristics influenced by the local regulations, economic conditions, and cultural factors. The Oilfield chemicals market is poised for a transformation as the global energy landscape changes. The need for new formulations and improved operational efficiencies will become a critical success factor for the companies.

Europe

- In Europe, the push for energy transition and stricter environmental regulations are driving the demand for biodegradable and non-toxic oilfield chemicals, with companies like BASF leading the way in developing innovative solutions.

- The European Union's Green Deal is influencing market dynamics, as it encourages investments in cleaner technologies and practices, prompting oilfield service companies to adapt their chemical offerings to meet new sustainability standards.

Asia Pacific

- The Asia-Pacific region is witnessing a surge in oilfield chemical demand due to increasing offshore drilling activities, particularly in countries like China and India, where companies such as Sinopec are expanding their chemical product lines.

- Innovations in enhanced oil recovery (EOR) techniques are gaining traction, with local firms investing in research and development to create specialized chemicals that improve oil extraction efficiency in challenging geological formations.

Latin America

- Latin America is experiencing growth in the oilfield chemicals market, particularly in Brazil and Mexico, where government initiatives to boost oil production are driving demand for specialized chemical products.

- The region's unique geological challenges are prompting local companies to innovate, with firms like Petrobras investing in research to develop chemicals that can effectively operate in high-salinity and high-temperature environments.

North America

- Oilfield chemicals are strongly influenced by the shale oil boom in the United States. Halliburton and Schlumberger are investing heavily in new chemicals to optimize extraction processes.

- The petroleum industry has also been obliged to develop more environment-friendly chemicals in recent years, following the introduction of legislation designed to limit the industry’s impact on the environment. The American Petroleum Institute, a trade association, has been advocating the use of such chemicals for some time.

Middle East And Africa

- In the Middle East and Africa, the oilfield chemicals market is significantly influenced by the region's vast oil reserves, with major players like Saudi Aramco focusing on advanced chemical solutions to enhance production efficiency.

- The region is also seeing increased collaboration between local companies and international firms to develop tailored chemical solutions that address specific challenges faced in the harsh operating environments typical of the region.

Did You Know?

“Did you know that the oilfield chemicals market is expected to see a major shift towards biobased chemicals, with projections that by 2025, over 30% of chemicals used in oilfield applications will be derived from renewable sources?” — International Energy Agency (IEA)

Segmental Market Size

Oilfield chemicals are essential for enhancing the efficiency of extraction and production of oil. The market is characterized by the growth of drilling fluids, production chemicals, and enhanced oil recovery (EOR) chemicals. Energy demand is growing, and companies are under pressure to optimize costs and reduce their impact on the environment. These demands are met by companies such as Halliburton and Schlumberger, which have invested heavily in the development of new formulations. In North America and the Middle East, where extensive extraction activities are carried out, the use of oilfield chemicals is already well established. Drilling and EOR are the main applications. Drilling fluids are used to maintain the stability of the wellbore, and EOR uses surfactants to increase the recovery of oil. These applications are the main drivers of growth. Other trends are the need to meet regulations on the environment and the integration of digital technology, such as the Internet of Things for monitoring the performance of chemicals. The use of green chemicals has been driven by regulations on the reduction of the carbon footprint.

Future Outlook

The oilfield chemicals market is expected to show a steady growth from 2025 to 2034, with a CAGR of 4.36%. This is due to the increasing demand for enhanced oil recovery methods and the increasing complexity of oilfield operations, which require more advanced chemicals. The demand for energy in the world is growing, especially in emerging economies. The need for more efficient and more effective extraction methods will lead to the use of specialized chemicals, such as drilling fluids, production chemicals and cementing agents. The penetration of chemicals into the oilfield operations will be 75% in 2034, up from 60% in 2025, which will represent a significant shift in the direction of reliance on chemicals. The development of bio-based and environmentally friendly oilfield chemicals will also have a significant impact on the market. The pressure of the authorities to reduce the impact of oil extraction on the environment will further accelerate the development of such chemical solutions. The use of digital technology, in particular the Internet of Things and data analysis, will increase the efficiency of chemical use, optimize performance and reduce costs. The industry must be able to respond to these trends and, by introducing innovations, meet market requirements and regulatory demands.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 17.02 Billion |

| Market Size Value In 2023 | USD 17,89 Billion |

| Growth Rate | 4.64% (2023-2030) |

Oil Field Chemicals Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.