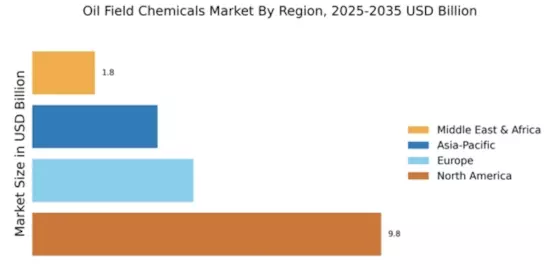

North America : Market Leader in Oil Chemicals

North America continues to lead the Oil Field Chemicals market, holding a significant share of 9.75 in 2024. The region's growth is driven by increasing oil production, technological advancements, and stringent environmental regulations that promote the use of efficient chemicals. The demand for enhanced oil recovery techniques and the rise of unconventional oil sources further bolster market expansion. Regulatory support for sustainable practices is also a key catalyst for growth. The competitive landscape in North America is characterized by the presence of major players such as Baker Hughes, Halliburton, and Schlumberger. These companies are investing heavily in R&D to innovate and improve their product offerings. The U.S. remains the leading country, with a robust infrastructure and a favorable business environment. The market is expected to continue its upward trajectory as companies adapt to evolving industry demands and regulatory frameworks.

Europe : Emerging Market with Growth Potential

Europe's Oil Field Chemicals market is poised for growth, with a market size of 4.5 in 2025. The region is witnessing increased investments in oil exploration and production, driven by the need for energy security and sustainability. Regulatory frameworks are becoming more supportive of innovative chemical solutions, which is expected to enhance market dynamics. The shift towards cleaner energy sources is also influencing the demand for specialized chemicals in oil recovery processes. Leading countries in this region include Germany, the UK, and Norway, where companies like BASF and Clariant are making significant contributions. The competitive landscape is evolving, with a focus on sustainable practices and technological advancements. The presence of established players and a growing number of startups are fostering innovation, making Europe a vibrant market for oil field chemicals.

Asia-Pacific : Rapidly Growing Oil Market

The Asia-Pacific region is emerging as a significant player in the Oil Field Chemicals market, with a size of 3.5 in 2025. The growth is fueled by increasing energy demands, particularly in countries like China and India, where oil consumption is on the rise. Regulatory initiatives aimed at enhancing production efficiency and environmental sustainability are also driving the market. The region's diverse geological formations require specialized chemical solutions, further boosting demand. China and India are the leading countries in this market, with a mix of domestic and international players competing for market share. Companies like Ecolab and Newpark Resources are expanding their footprint in the region. The competitive landscape is characterized by a focus on innovation and partnerships, as firms seek to address the unique challenges posed by the region's oil fields. The market is expected to grow as investments in infrastructure and technology continue to rise.

Middle East and Africa : Resource-Rich Oil Frontier

The Middle East and Africa region, with a market size of 1.75 in 2025, is rich in oil resources, making it a critical area for the Oil Field Chemicals market. The growth is driven by the region's vast oil reserves and increasing investments in oil extraction technologies. Regulatory frameworks are evolving to support sustainable practices, which is expected to enhance the market landscape. The demand for advanced chemical solutions is rising as companies seek to optimize production and reduce environmental impact. Leading countries in this region include Saudi Arabia, UAE, and Nigeria, where major players are actively involved in the oil sector. The competitive landscape features both established companies and new entrants, focusing on innovation and efficiency. The presence of key players like Weatherford International and Chemicals underscores the region's potential for growth in the oil field chemicals market.