- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

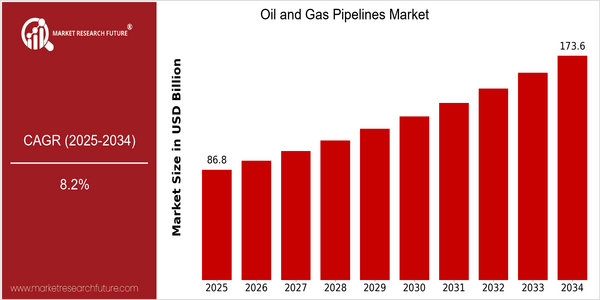

| Year | Value |

|---|---|

| 2025 | USD 86.81 Billion |

| 2034 | USD 173.55 Billion |

| CAGR (2025-2034) | 8.2 % |

Note – Market size depicts the revenue generated over the financial year

The oil and gas pipe-line market is expected to grow at a steady rate. The current market value of $86,813,971,000 in 2025 is expected to nearly double to $173,555,500,000 by 2034. This steady growth is reflected in a compound annual growth rate (CAGR) of 8.2 percent during the forecast period. The major reason for this growth is the rising demand for energy, which is mainly due to the increasing population and industrialization. Also, the shift towards cleaner energy sources and the need for efficient transportation of oil and gas resources are driving the investments in oil and gas pipe-line technology and construction. The advancements in technology, like smart piping and the improved materials used for pipe-line construction, are also contributing to the market growth. The companies like Enbridge, Trans Canada, and Kinder Morgan are the major players in the market. They are concentrating on enhancing their operational efficiencies and expanding their market reach by investing in new pipe-line projects. These developments, which not only improve safety and reduce the impact on the environment, but also support the transition towards a more sustainable energy system, are expected to further drive the growth of the oil and gas pipe-line market in the coming years.

Regional Market Size

Regional Deep Dive

The Oil and Gas Pipeline Market is characterized by the complex interplay of demand, regulatory framework, and technological advancements across different regions. North America is characterized by a robust network of pipelines and the growing shale gas production. Europe is characterized by a focus on reducing carbon emissions and increasing the efficiency of energy resources. The Asia-Pacific region is characterized by a rapidly growing energy demand owing to the increasing industrialization. This, in turn, is driving the growth of the Oil and Gas Pipeline Market. The Middle East and Africa are rich in oil and gas reserves and are undertaking several projects to increase their export capabilities. Latin America is also investing in the conventional and green energy pipelines. Each region has its own opportunities and challenges, depending on the local economic conditions, regulatory framework, and technological innovations.

Europe

- The European Union's Green Deal aims to reduce greenhouse gas emissions, prompting investments in carbon capture and storage (CCS) pipelines, with companies like Equinor leading the charge.

- Regulatory changes, such as the EU's Gas Package, are reshaping the market by promoting competition and transparency in gas supply, impacting how pipelines are developed and operated.

Asia Pacific

- China's Belt and Road Initiative is significantly influencing the pipeline market, with investments in cross-border pipelines to enhance energy security and connectivity across Asia.

- India is ramping up its pipeline infrastructure to support its growing energy needs, with projects like the Pradhan Mantri Urja Ganga project aimed at expanding natural gas access.

Latin America

- Brazil is investing heavily in its oil and gas pipeline infrastructure, with the Transpetro pipeline expansion project aimed at improving distribution and reducing costs.

- Regulatory reforms in Mexico's energy sector are attracting foreign investment in pipeline projects, with companies like TC Energy and IEnova actively participating in the market.

North America

- The Biden administration's focus on renewable energy has led to increased scrutiny of pipeline projects, with several proposed projects facing regulatory hurdles, such as the Keystone XL pipeline cancellation.

- Technological advancements in pipeline monitoring and leak detection, such as the use of drones and AI, are being adopted by companies like Enbridge and TransCanada to enhance safety and efficiency.

Middle East And Africa

- Saudi Arabia's Vision 2030 is driving investments in pipeline infrastructure to diversify its economy and enhance oil export capabilities, with projects like the East-West Pipeline being pivotal.

- The African Continental Free Trade Area (AfCFTA) is expected to boost regional energy cooperation, leading to increased investments in pipeline projects across the continent.

Did You Know?

“Approximately 70% of the world's oil and gas is transported through pipelines, making them a critical component of the global energy infrastructure.” — International Energy Agency (IEA)

Segmental Market Size

The Oil and Gas Pipelines market is currently growing steadily, driven by the increasing demand for energy and the need to transport hydrocarbons more efficiently. This is mainly due to the growing energy consumption in emerging countries, which is also accompanied by the implementation of government policies aimed at reducing greenhouse gas emissions. Technological advances in the monitoring and maintenance of the pipes are also boosting the demand for more reliable transport. At the same time, the industry is now at a mature stage of development, as evidenced by the example of the Trans-Canada Keystone Pipeline and the Nord Stream Pipeline in Europe. The main application is the transport of crude oil, natural gas and refined products. The best companies in this industry are Enbridge and Kinder Morgan. The main trends are the increasing demand for energy and the need to transport it more efficiently. Pipeline monitoring systems and the use of new materials are shaping the development of this industry, making it safer and more efficient.

Future Outlook

The oil and gas industry is expected to grow significantly from 2025 to 2034, with a CAGR of 8.2 percent. The increase in energy consumption in the world is driven by population growth and industrialization, especially in emerging economies. As a result, the world's energy resources are becoming scarce, and countries are investing more and more in oil and gas production, reducing the dependence on imports and promoting the development of their own oil and gas industry. The key technology and policy changes in the future will play a crucial role in shaping the industry. The combination of smart sensors and advanced monitoring systems can greatly improve the safety and efficiency of the operation of the oil and gas industry, reduce the possibility of leakage and reduce the risk of pollution, and make the oil and gas industry more sustainable. In addition, the shift to sustainable energy and the need to produce cleaner energy will drive the construction of new pipelines to transport clean energy such as hydrogen and biofuels. The development of the industry will also be driven by the government's policy support. The policy environment will change, and both the traditional oil and gas companies and the new energy companies will participate in the market, which will diversify the competition and promote innovation.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 8.00% (2024-2032) |

Oil & Gas Pipeline Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.