- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

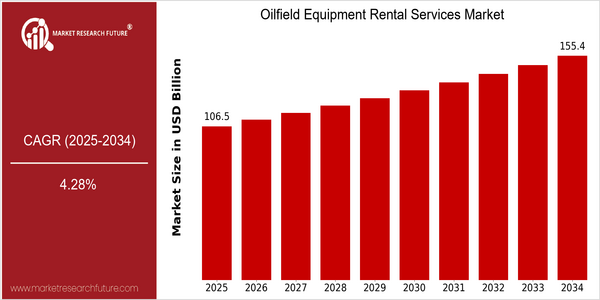

| Year | Value |

|---|---|

| 2025 | USD 106.55 Billion |

| 2034 | USD 155.4 Billion |

| CAGR (2025-2034) | 4.28 % |

Note – Market size depicts the revenue generated over the financial year

The Oilfield Equipment Rental Services Market is poised for significant growth, with a current market size of USD 106.55 billion in 2025, projected to expand to USD 155.4 billion by 2034. This growth trajectory reflects a compound annual growth rate (CAGR) of 4.28% over the forecast period. The increasing demand for oil and gas, coupled with the rising need for cost-effective solutions in exploration and production, is driving this market forward. As companies seek to optimize their operations and reduce capital expenditures, the rental model for oilfield equipment has gained traction, allowing for greater flexibility and efficiency in resource management. Technological advancements, such as the integration of IoT and automation in oilfield operations, are further propelling market growth. These innovations enhance equipment performance and reliability, making rental services more attractive to operators. Key players in the market, including Schlumberger, Halliburton, and Baker Hughes, are actively investing in new technologies and forming strategic partnerships to enhance their service offerings. For instance, recent collaborations aimed at developing advanced rental solutions and expanding geographic reach underscore the competitive landscape's dynamism. As the industry evolves, the focus on sustainability and reducing environmental impact will also shape the future of oilfield equipment rental services.

Regional Market Size

Regional Deep Dive

The Oilfield Equipment Rental Services Market is characterized by a dynamic landscape influenced by regional energy demands, technological advancements, and regulatory frameworks. In North America, the market is driven by a resurgence in shale oil production and a focus on cost-effective solutions. Europe is witnessing a shift towards sustainable practices, while Asia-Pacific is rapidly expanding due to increasing energy consumption. The Middle East and Africa are capitalizing on their vast oil reserves, and Latin America is focusing on infrastructure development to enhance its oilfield services. Each region presents unique opportunities and challenges that shape the overall market dynamics.

Europe

- The European Union's Green Deal is influencing oilfield operations, prompting rental service companies to invest in sustainable technologies, such as electric-powered drilling equipment.

- Key players like Baker Hughes are collaborating with local governments to develop projects that align with renewable energy goals, reshaping the traditional oilfield rental landscape.

Asia Pacific

- China's Belt and Road Initiative is driving infrastructure investments, leading to increased demand for oilfield equipment rental services in emerging markets across the region.

- Innovations in digital technologies, such as IoT and AI, are being adopted by companies like Weatherford to enhance equipment efficiency and reduce downtime, significantly impacting service delivery.

Latin America

- Brazil's pre-salt oil fields are attracting significant foreign investment, leading to a surge in demand for rental services from companies like Petroamazonas.

- Regulatory reforms in countries like Colombia are streamlining the approval processes for oilfield projects, encouraging rental service providers to expand their operations in the region.

North America

- The rise of shale oil production in the U.S. has led to increased demand for rental services, with companies like Halliburton and Schlumberger expanding their rental fleets to meet this need.

- Regulatory changes in Canada, particularly around environmental standards, are pushing rental service providers to innovate and offer more eco-friendly equipment, impacting operational costs and service offerings.

Middle East And Africa

- Saudi Aramco's ongoing projects to enhance oil production capabilities are creating substantial opportunities for rental service providers, with companies like National Oilwell Varco actively participating.

- The region's unique geopolitical landscape necessitates compliance with various regulations, which is prompting rental service companies to adapt their strategies to ensure operational continuity.

Did You Know?

“Did you know that the oilfield equipment rental market is expected to see a significant shift towards digital solutions, with companies increasingly adopting IoT technologies to monitor equipment performance in real-time?” — Market Research Future

Segmental Market Size

The Oilfield Equipment Rental Services segment plays a crucial role in the oil and gas industry, currently experiencing stable growth due to increasing exploration and production activities. Key drivers of demand include the rising need for cost-effective solutions in oilfield operations and the growing emphasis on operational efficiency, which encourages companies to rent rather than purchase equipment. Additionally, regulatory policies promoting environmental sustainability are pushing firms to adopt rental services that minimize capital expenditure and enhance flexibility. Currently, the adoption stage of oilfield equipment rental services is in a mature phase, with companies like Schlumberger and Halliburton leading the market through extensive rental fleets and innovative service offerings. Primary applications include drilling, completion, and production operations, where equipment such as drilling rigs and pressure control systems are frequently utilized. Trends such as the shift towards digitalization and automation in oilfield operations, alongside sustainability initiatives, are accelerating growth in this segment. Technologies like IoT and advanced analytics are shaping the evolution of rental services, enabling real-time monitoring and predictive maintenance, thus enhancing operational efficiency.

Future Outlook

The Oilfield Equipment Rental Services Market is poised for significant growth from 2025 to 2034, with a projected market value increase from $106.55 billion to $155.4 billion, reflecting a compound annual growth rate (CAGR) of 4.28%. This growth trajectory is underpinned by the rising demand for oil and gas, driven by global energy needs and the ongoing recovery of the sector post-pandemic. As operators seek to optimize costs and enhance operational efficiency, the rental model is becoming increasingly attractive, allowing companies to access advanced equipment without the burden of ownership. By 2034, it is anticipated that rental services will account for approximately 30% of total oilfield equipment expenditures, up from around 20% in 2025, indicating a shift towards more flexible operational strategies in the industry. Key technological advancements, particularly in automation and digitalization, are expected to further propel the market. The integration of IoT and AI in oilfield operations will enhance equipment monitoring and predictive maintenance, reducing downtime and operational costs. Additionally, environmental regulations and a global push towards sustainable practices are likely to drive demand for rental services that offer eco-friendly equipment options. Emerging trends such as the increasing adoption of renewable energy sources and hybrid solutions will also shape the market landscape, compelling rental service providers to innovate and diversify their offerings. Overall, the Oilfield Equipment Rental Services Market is set to evolve significantly, driven by a combination of economic, technological, and regulatory factors that favor flexible and efficient operational models.

Oilfield Equipment Rental Services Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.