Global Economic Recovery

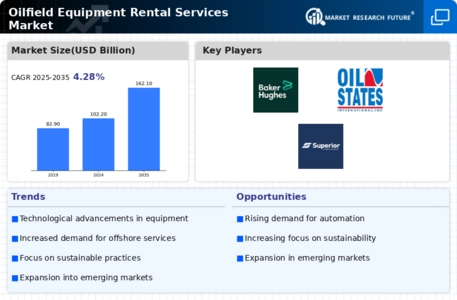

The Global Oilfield Equipment Rental Services Market Industry is poised to benefit from the ongoing global economic recovery. As economies rebound, investments in infrastructure and energy projects are expected to rise, driving demand for oilfield services. This recovery is likely to stimulate exploration and production activities, leading to an increased need for rental equipment. The market's resilience in adapting to changing economic conditions suggests a favorable outlook for growth. With the projected market size reaching 162.1 USD Billion by 2035, the industry appears well-positioned to capitalize on the revitalized economic landscape, further enhancing its relevance in the global energy sector.

Technological Advancements

Technological innovations play a pivotal role in shaping the Global Oilfield Equipment Rental Services Market Industry. The adoption of advanced technologies such as automation, IoT, and data analytics enhances operational efficiency and safety in oilfield operations. Rental service providers are increasingly offering state-of-the-art equipment that incorporates these technologies, allowing operators to optimize resource utilization and reduce downtime. This trend not only improves productivity but also aligns with the industry's shift towards sustainability. As the market evolves, the integration of cutting-edge technology is likely to attract more clients, contributing to the anticipated growth of the market to 162.1 USD Billion by 2035.

Increasing Demand for Energy

The Global Oilfield Equipment Rental Services Market Industry is witnessing a surge in demand for energy, driven by the growing global population and industrialization. As countries strive to meet energy needs, the exploration and production of oil and gas are intensifying. This trend is reflected in the projected market size of 102.2 USD Billion in 2024, indicating a robust growth trajectory. The need for efficient and cost-effective solutions in oilfield operations has led to an increased reliance on rental services, allowing companies to access advanced equipment without the burden of ownership. This shift is expected to propel the market further as energy demands escalate.

Cost Efficiency and Flexibility

Cost efficiency remains a critical driver in the Global Oilfield Equipment Rental Services Market Industry. Companies are increasingly opting for rental services to mitigate capital expenditures associated with purchasing and maintaining equipment. This approach allows operators to allocate resources more effectively and respond swiftly to market fluctuations. The flexibility offered by rental agreements enables firms to scale operations according to project demands, enhancing overall competitiveness. As the industry continues to evolve, the ability to access high-quality equipment without long-term commitments is likely to attract more clients, contributing to the projected growth of the market in the coming years.

Regulatory Support and Compliance

The Global Oilfield Equipment Rental Services Market Industry benefits from supportive regulatory frameworks that encourage exploration and production activities. Governments worldwide are implementing policies aimed at enhancing energy security and reducing dependence on imports. This regulatory environment fosters investment in oilfield services, including equipment rentals. Compliance with environmental and safety regulations also drives demand for specialized rental equipment that meets stringent standards. As companies seek to navigate these regulations effectively, the reliance on rental services is expected to increase, further propelling market growth. The anticipated CAGR of 4.28% from 2025 to 2035 underscores the positive outlook for the industry.