Oilfield Auxiliary Rental Equipment Market Summary

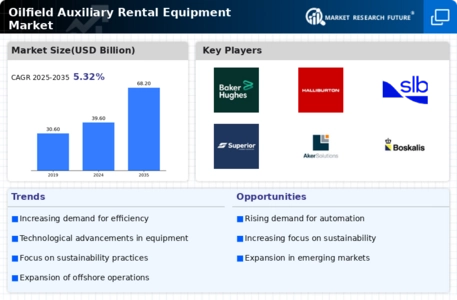

As per Market Research Future analysis, the Oilfield Auxiliary Rental Equipment Market was estimated at 39.6 USD Billion in 2024. The Oilfield Auxiliary Rental Equipment industry is projected to grow from 41.6 USD Billion in 2025 to 67.96 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.0% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Oilfield Auxiliary Rental Equipment Market is experiencing a dynamic shift towards rental solutions driven by technological advancements and sustainability initiatives.

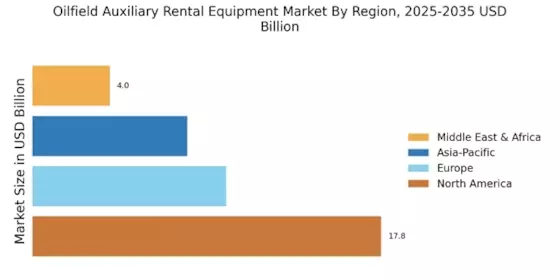

- The demand for rental solutions is increasing, particularly in North America, which remains the largest market for oilfield auxiliary equipment.

- Technological advancements are enhancing operational efficiency, particularly in the production equipment segment, which is currently the largest.

- The Asia-Pacific region is emerging as the fastest-growing market, driven by rising exploration activities and investments in oilfield services.

- Cost efficiency and flexibility are major drivers, as companies increasingly prefer short-term rentals to adapt to fluctuating market conditions.

Market Size & Forecast

| 2024 Market Size | 39.6 (USD Billion) |

| 2035 Market Size | 67.96 (USD Billion) |

| CAGR (2025 - 2035) | 5.03% |

Major Players

Schlumberger (US), Halliburton (US), Baker Hughes (US), Weatherford International (US), National Oilwell Varco (US), Aker Solutions (NO), TechnipFMC (GB), Superior Energy Services (US), Cameron International (US)