Research Methodology on Aircraft Auxiliary Power Unit Market

1. Introduction

The purpose of this research is to provide an in-depth analysis of the aircraft auxiliary power unit (APU) market and to evaluate the current market size, trends and prospects for the industry over the forecast period (2024-2030). The report focuses on the major drivers of the APU industry, such as new technology development and rising demand for these systems in commercial and defence applications. The methodology used in this report follows globally accepted research techniques.

2. Research Approach

The research approach for this report adopts a mix of exploratory and analytical techniques. The exploratory techniques that were used include primary data collection such as interviews with key opinion leaders and end-user customers. Secondary research techniques were employed to analyze the industry data from reputable sources such as industry reports, journals, magazines and press releases. The primary research sources were validated and corroborated with secondary research sources.

3. Market Scope

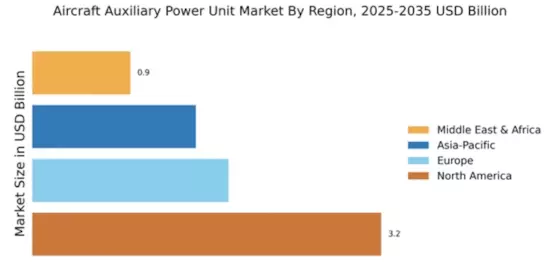

The scope of the research report includes an analysis of the global aircraft auxiliary power unit market based on product type, platform, application, and region. Market size estimation and the forecast are carried out using both top-down and bottom-up approaches.

4. Data Mining

Data mining is the process of collecting, organizing, and interpreting pieces of data to come up with useful information. Data is mined from a wide range of sources, including primary and secondary sources. All the collected data are processed through advanced analytics to get meaningful and accurate insights.

5. Market Estimation

The market size estimation is carried out taking into consideration all available data and information from primary and secondary sources including trade associations, government agencies, industry associations, and research and development centres. The estimation is based on the market share, market size, and revenue of the manufacturers.

6. Research Assumptions

The assumptions that were made for the research are:

- That APU manufacturers will continue to invest in developing new technology to meet the growing demand from customers.

- The market size of aircraft auxiliary power units will grow steadily in the forecast period due to the increase in new commercial and defence applications.

7. Conclusion

The research report contains a comprehensive analysis of the aircraft auxiliary power unit market, making use of both primary and secondary research sources. Market size estimation is done using top-down and bottom-up approaches. The report provides insights into the current market size, trends and prospects for the industry over the forecast period. The research assumptions that were made for the study helped the researchers gain accurate insights into the market. The data and information gathered are accurate and reliable to provide meaningful and useful insights.