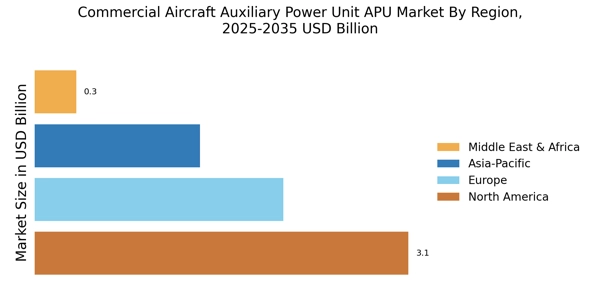

Emerging Markets and Regional Expansion

Technological Advancements in APU Design

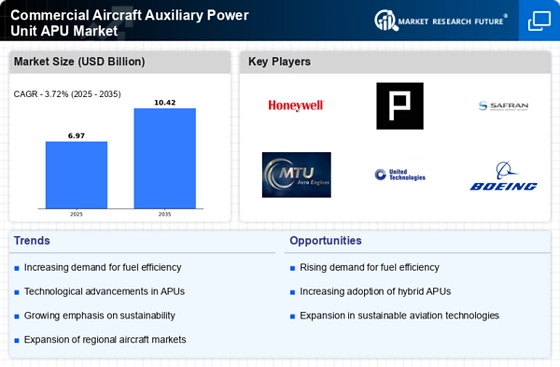

The commercial aircraft auxiliary power unit apu Market is experiencing a surge in technological advancements that enhance efficiency and performance. Innovations such as improved fuel efficiency and reduced emissions are becoming increasingly prevalent. For instance, the integration of advanced materials and digital technologies is enabling manufacturers to produce lighter and more efficient APUs. This trend is likely to drive demand as airlines seek to reduce operational costs while adhering to stringent environmental regulations. Furthermore, the introduction of hybrid and electric APUs is anticipated to reshape the market landscape, offering airlines sustainable alternatives that align with global sustainability goals. As a result, the Commercial Aircraft Auxiliary Power Unit APU Market is poised for significant growth, driven by these technological innovations.

Cost Efficiency and Operational Reliability

Cost efficiency and operational reliability are critical drivers in the Commercial Aircraft Auxiliary Power Unit APU Market. Airlines are continuously seeking ways to optimize their operational costs, and APUs play a vital role in achieving this goal. Efficient APUs reduce fuel consumption during ground operations, leading to significant cost savings over time. Moreover, reliable APUs minimize downtime and maintenance costs, which are crucial for airlines operating on tight schedules. The demand for APUs that offer high reliability and low total cost of ownership is increasing, as airlines aim to enhance their operational efficiency. Consequently, manufacturers are focusing on developing APUs that not only meet performance standards but also provide long-term cost benefits, thereby driving growth in the Commercial Aircraft Auxiliary Power Unit APU Market.

Increasing Fleet Sizes and Air Travel Demand

The Commercial Aircraft Auxiliary Power Unit APU Market is benefiting from the increasing fleet sizes and rising air travel demand. As more airlines expand their operations to accommodate growing passenger numbers, the need for efficient and reliable APUs becomes paramount. According to industry forecasts, The Commercial Aircraft Auxiliary Power Unit APU is projected to grow steadily, leading to an increase in aircraft deliveries. This growth directly correlates with the demand for APUs, as each aircraft requires a dedicated APU for ground operations and auxiliary power. Additionally, the trend of airlines modernizing their fleets with newer aircraft equipped with advanced APUs further supports market expansion. Thus, the increasing fleet sizes and air travel demand are likely to be key drivers in the Commercial Aircraft Auxiliary Power Unit APU Market.

Sustainability Initiatives and Regulatory Compliance

The Commercial Aircraft Auxiliary Power Unit APU Market is significantly influenced by sustainability initiatives and regulatory compliance. Airlines are increasingly pressured to reduce their carbon footprints, leading to a heightened focus on environmentally friendly technologies. Regulatory bodies are implementing stringent emissions standards, compelling manufacturers to innovate and develop APUs that meet these requirements. The market is witnessing a shift towards more sustainable APU solutions, such as those utilizing alternative fuels or hybrid technologies. This transition not only helps airlines comply with regulations but also enhances their brand image among environmentally conscious consumers. Consequently, the demand for advanced APUs that align with sustainability goals is expected to rise, further propelling the growth of the Commercial Aircraft Auxiliary Power Unit APU Market.