Okra Seeds Size

Okra Seeds Market Growth Projections and Opportunities

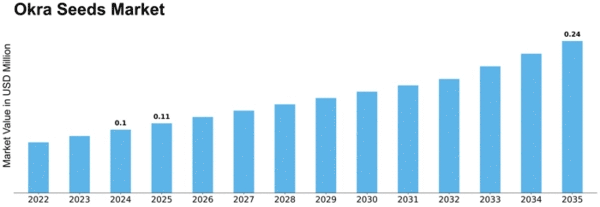

The global market for okra seeds has experienced sustained growth in recent years and is anticipated to reach USD 352.7 million by 2023, showcasing a Compound Annual Growth Rate (CAGR) of 9.8%. This growth is propelled by the escalating demand for high-quality fruits and vegetables, encompassing an increased need for seeds, particularly in the case of okra. Moreover, the surge in the adoption of organic farming practices is anticipated to further contribute to the demand for organic okra seeds in the foreseeable future. The ongoing trend of heightened exports of fresh vegetables from emerging economies is poised to create promising opportunities for producers of okra seeds.

One of the primary drivers of the global okra seeds market is the escalating demand for premium-quality fruits and vegetables. Consumers globally are increasingly seeking high-quality produce, and this trend has significantly impacted the demand for seeds that facilitate the cultivation of superior crops, including okra. The versatility of okra as a vegetable, used in various culinary applications, has amplified its popularity, further contributing to the growth of the okra seeds market.

The adoption of organic farming practices is gaining momentum across the agricultural landscape. This shift towards organic methods is driven by the growing awareness and preference for chemical-free and environmentally sustainable agricultural production. Okra seeds, being a crucial component in the cultivation of this vegetable, are witnessing increased demand within the organic farming segment. Organic okra seeds are sought after by farmers who aim to produce okra without the use of synthetic chemicals and fertilizers, aligning with the preferences of an environmentally conscious consumer base.

A noteworthy trend influencing the okra seeds market is the expanding exports of fresh vegetables, especially from emerging economies. As these economies participate more actively in international trade, there is a growing market for fresh produce, including okra. The demand for okra seeds is anticipated to rise as farmers seek to capitalize on the export potential of this vegetable. The cultivation of okra with improved attributes, such as disease resistance, enhanced shelf life, and uniform size, becomes crucial in meeting the stringent quality standards often imposed by international markets.

The projections for the okra seeds market indicate promising opportunities for producers and stakeholders involved in the entire supply chain. With the rising demand for okra seeds, there is an inherent potential for business growth and profitability. As global consumers continue to prioritize quality, health, and sustainability, the market for okra seeds is poised to benefit from these trends.

Leave a Comment