ONGOING INFRASTRUCTURE PROJECTS IN OMAN DRIVE THE DEMAND FOR HOT DIP GALVANIZED STEEL

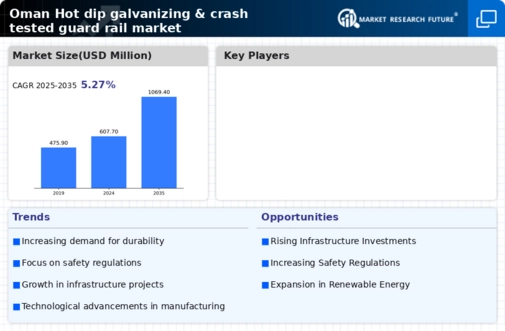

Rapid growth in urbanization and infrastructure development, drives the demand for hot dip galvanizing (HDG) market. The hot dip galvanizing (HDG) market in Oman is driven by way of various factors that replicate the country's unique economic, industrial, and infrastructural landscape. Ongoing projects and investments additionally contribute to the overall increase of the market.

The building and construction sector in Oman is a major driver of the nation's economic growth. By 2023, the market size of building and construction sector is projected to be worth USD 19.4 billion, considering infrastructure, residential development, and the building of strength and utilities. To attract extra foreign capital and diversify the financial system, the government is making enormous investments in the nation's infrastructure development. This growth is fuelled by the government’s ambitious infrastructure projects, such as the expansion of the Muscat International Airport and the development of the new Salalah airport.

For Instance, the Batinah Expressway, a major street project, extends over 270 kilometres and connects Muscat with the UAE border, consequently, such type of initiatives requires massive quantity of galvanized metal for guardrails, bridges, and assist structures, all of which gain from galvanizing to prevent rust and corrosion and decorate the shelf lifestyles. Galvanized metallic gives the specified protection against corrosion, lowering upkeep costs and extending the lifespan of these systems.

Additionally, a substantial infrastructure ventures the Port of Duqm is aimed at establishing Oman as a key marine hub. The production of assisting centers, piers, docks require massive quantities of galvanized metallic to face up to the destructive marine environment. Moreover, the government's attention on enhancing infrastructure to boost economic growth is driving the call for galvanized metallic, that is critical for production because of its corrosion-resistant residences drives the hot dip galvanizing (HDG) market in Oman.

For Instance, the Ministry of Transport, Communications and Information Technology, Oman signed an agreement to the music of RO 79 million for the implementation, layout, and finalization of the primary segment of Al Batinah Coastal Road. The construction area in Oman is experiencing widespread growth, driven by way of both residential and industrial initiatives. Large-scale real estate developments and urbanization initiatives require durable and long-lasting construction materials, leading to increased demand for HDG. Hence various developments and plans drives the infrastructure development which in turn drives the demand hot dip galvanizing (HDG) market in Oman.

RISING DEMAND FOR AUTOMOTIVE AND TRANSPORT INDUSTRIES

The automotive and transportation sector in Oman presents several opportunities for the Hot Dip Galvanizing (HDG) market. This is due to environmentally resilient materials that can withstand harsh environmental conditions and increase the longevity of vehicles and accessories While Oman is seeking to provide its economy has diversified, more emphasis is placed on increasing local manufacturing Parts such as car bodies, chassis and frames require galvanized steel.

Additionally, Oman’s harsh climate, with its high humidity, humidity and salty environments leads to rapid degradation of auto parts HDG offers reliable solutions to protect vehicles from rust and corrosion, increasing durability and reducing maintenance costs.

Furthermore, with Oman’s transition to electric vehicles (EV) and Oman’s interest in adopting sustainable transportation solutions, there is a need for robust infrastructure including charging stations and related accessories Galvanized steel is ideal for these installations because of their durability and resistance to environmental degradation.

Local auto parts manufacturers can use HDG for parts such as exhaust systems, fuel tanks and underbody parts. These products benefit from the advanced protection provided by galvanizing, which is critical to vehicle longevity and performance. The development of public transport systems such as bus and rigid transit (BRT) and rail networks provides opportunities for the use of galvanized steel in stations and associated infrastructure HDG ensures the durability and maintenance of these areas several. The need for safety features such as barrier barriers, pedestrian crossings and highway markings is driving the demand for galvanized steel.

These structures must be environmentally resilient and provide reliable safety features for road users.

Exploiting these opportunities could significantly boost Oman’s HDG market, contributing to both automotive and transportation sectors’ domestic galvanized steel consumption and diversification of Oman’s economy consistent with implementation development objectives.