Open System Isolator Size

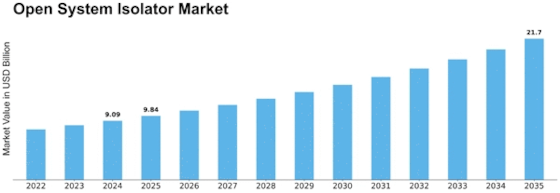

Open System Isolator Market Growth Projections and Opportunities

Pharmaceutical isolators are special equipment used in the pharmaceutical industry to prevent contamination during manufacturing and other processes. They are designed to protect workers from exposure to drugs, prevent cross-contamination, and maintain the quality of the drugs. The global pharmaceutical isolator market is expected to grow due to factors such as the increasing pharmaceutical industry, research and development investments, and government regulations for drug safety. However, the high cost of installing and maintaining isolators may hinder market growth.

The global pharmaceutical isolator market is projected to reach USD 32,944.3 million by 2023, with a Compound Annual Growth Rate (CAGR) of 7.86% during the forecast period from 2018 to 2023. In 2017, the Americas led the market with a 36.4% share, followed by Europe and Asia-Pacific with shares of 34.0% and 24.7%, respectively.

The market is segmented based on the type of isolators, pressure, application, and end-user. Open isolators accounted for the largest market share of 60.5% in 2017, with a value of USD 12,622.5 million. Positive pressure isolators accounted for the largest market share of 55.5% in terms of pressure, valued at USD 11,581.1 million. Aseptic filling was the largest application segment with a market share of 27.9% and a value of USD 5,830.3 million. Pharmaceutical and biotechnological companies were the largest end-user segment, accounting for 45.8% of the market share and a value of USD 9,552.5 million.

In summary, pharmaceutical isolators are crucial equipment in the pharmaceutical industry to prevent contamination and ensure drug safety. The market is expected to grow due to the expanding pharmaceutical sector, increased research and development activities, and government regulations. However, the high cost of isolators may pose a challenge to market growth. The market is segmented based on isolator type, pressure, application, and end-user, with open isolators, positive pressure isolators, aseptic filling, and pharmaceutical and biotechnological companies being the dominant segments, respectively. The global pharmaceutical isolator market offers significant opportunities for manufacturers and suppliers in the industry.

Leave a Comment