Optical Transceiver Size

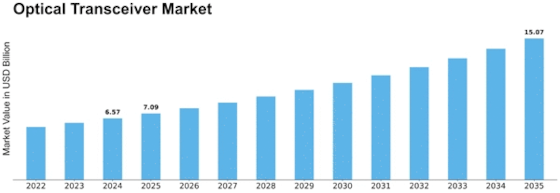

Optical Transceiver Market Growth Projections and Opportunities

Both the dynamics and growth trajectory of this market are jointly influenced by several forces. Perhaps the most important because of this: ceaseless demands for high-speed data transmission. Given the increasingly global competition for applications and services that are data-driven, requirements of efficient as well as high capacity communication infrastructures cannot be denied. This demand is being met by optical transceivers. They have enabled the fast and reliable transmission of data over optical fibers, thus becoming key components for modern communications networks. Also, the rapid transformations itself of telecommunications networks--especially as 5G is spreading across society--affects very much the optical transceiver market. Capable of data rates never before seen, with the requirement for low latency as well as a quantity and variety to be connected that is increasing exponentially every day, 5G networks will usher in this transition. To harvest the promise of 5G, a next-generation communications standard that delivers high speeds and low latency demands much more than just a few optical transceivers scattered throughout an infrastructure. As 5G networks are being introduced in many countries, this is a powerful driving force for sustainable growth of the optical transceiver market. The competitive landscape in the optical transceiver industry also affects market dynamics. In the fight for market share, major players can also be seen making heavy investments through development and introduction new products. The ideal goal here is transceivers with better performance, higher data rates and superior energy efficiency. Such a competitive environment breeds innovation, desirable for end-users who want the most advanced technologies. It also serves to help drive ideal optical transceiver solutions overall. Customer preferences and an ever-changing industry are also important factors. For instance, users range from telecommunications providers to enterprise customers. They want optical transceivers with performance to today's specification, but that also provide for scalability and compatibility needs in the future. Standards are created and updated by standardization bodies and industry alliances, so as to enable interoperability across the products that populate our lives. At the same time they promote new technologies by hastening their adoption. Adding to the market's overall dynamism are constant advances in technology. Other major factors influencing the market include materials, manufacturing processes and design. As the technological development of optical transceivers continues, a wider range of applications and growing requirements for speed pressure compels implementation that is increasingly more efficient and reliable in terms to communication information.

Leave a Comment