Market Share

Oral Cancer Diagnostics Market Share Analysis

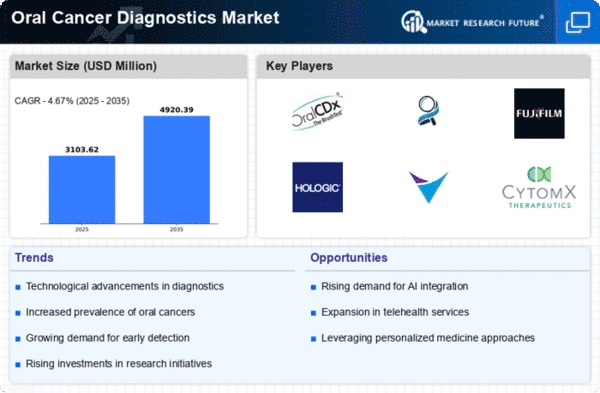

In the year 2018, the Americas emerged as the front-runner in the market, securing the largest share at 42.38%, valued at USD 1,852.35 million. The market is set for growth, with an expected rise at a rate of 7.13% during the forecast period. Following closely, Europe took the position of the second-largest market in 2018, with a value of USD 1,230.08 million, and is anticipated to grow at a rate of 6.40%. The Asia-Pacific market is poised for the highest growth rate, projected to experience an expected Compound Annual Growth Rate (CAGR) of 8.03%.

Now, let's explore the specifics of Mucoepidermoid Carcinoma (MEC), a distinct type of tumor commonly found in the minor salivary gland in adults. This tumor may also occur in the thyroid gland, bronchi, and lacrimal sac. While it is less common in the submandibular glands or minor salivary glands inside the mouth, certain factors like old age, exposure to radiation, and workplace contact with substances such as asbestos mining, plumbing, and rubber manufacturing increase the risk of salivary gland tumors. According to the Oral Cancer Foundation, MEC accounts for approximately 35% of all malignancies affecting major and minor salivary glands globally.

The growing prevalence of salivary gland cancers worldwide is expected to drive the demand for diagnostics, contributing to market growth during the forecast period. Information from the American Cancer Society in September 2017 indicates that salivary gland cancer constitutes less than 1% of cancers in the US, occurring at a rate of about 1 case per 100,000 individuals per year. The diagnosis of MEC involves various methods such as X-ray, computed tomography, magnetic resonance imaging, positron emission tomography, and biopsy. These diagnostic tools play a crucial role in identifying and understanding the characteristics of Mucoepidermoid Carcinoma, enabling healthcare professionals to make informed decisions about treatment strategies. The ongoing advancements in diagnostic technologies further contribute to enhancing the accuracy and efficiency of MEC diagnosis.

In conclusion, the regional market dynamics and the specific case of Mucoepidermoid Carcinoma highlight the complexities and nuances in the field of oral cancer diagnostics. As the market continues to evolve, propelled by technological innovations and increasing awareness, it is poised for sustained growth, particularly in the context of addressing specific types of oral cancers like Mucoepidermoid Carcinoma.

Leave a Comment