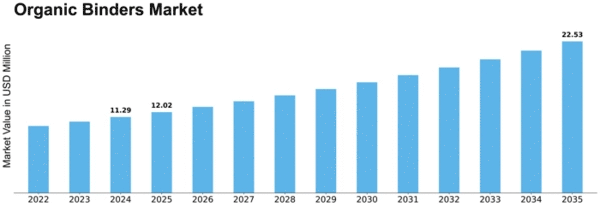

Organic Binders Size

Organic Binders Market Growth Projections and Opportunities

The Subsea Organic Binders Market experiences influence from various factors that collectively shape its trends and growth patterns. One key driver is the expanding demand for organic binders in subsea applications, particularly in the oil and gas industry. Organic binders play a crucial role in subsea systems by aiding in the formation and stabilization of pellets used for gas hydrate inhibitors and other subsea processes. As subsea exploration and production activities continue to grow, driven by the need for new energy resources, the demand for efficient and reliable organic binders rises.

Global economic conditions play a significant role in the Subsea Organic Binders Market. Economic growth and industrialization contribute to increased energy demand, prompting investments in subsea oil and gas projects. Developing economies, undergoing rapid industrial expansion, particularly drive the market's growth, as they become key players in the global energy landscape.

Technological advancements in binder formulations and application methods impact the market dynamics. Ongoing research and development efforts lead to innovations that enhance the performance, stability, and compatibility of organic binders in subsea environments. Companies that invest in these technological advancements gain a competitive edge by offering binders that meet the evolving needs of subsea applications while ensuring reliability and efficiency in challenging conditions.

Environmental considerations are crucial factors in the Subsea Organic Binders Market. As the industry faces increasing pressure to adopt sustainable and environmentally friendly practices, the use of organic binders that meet eco-friendly standards becomes essential. Companies in the market must develop binders with minimal environmental impact, aligning with regulatory requirements and industry expectations for responsible and sustainable subsea operations.

Geopolitical factors and trade dynamics play a role in shaping the Subsea Organic Binders Market. Fluctuations in trade relations, changes in tariffs, and geopolitical tensions can impact the supply chain and pricing of organic binders. Companies need to stay informed about global trade developments and adjust their strategies to navigate potential risks and capitalize on emerging opportunities in the global market.

Moreover, the oil and gas industry significantly contribute to the demand for Subsea Organic Binders. As subsea exploration and production activities increase, the need for efficient solutions to manage and inhibit gas hydrate formation becomes critical. Organic binders play a key role in preventing the agglomeration of hydrate particles, ensuring the smooth operation of subsea systems and pipelines.

The environmental conditions in subsea applications, characterized by high pressures and low temperatures, necessitate binders with specific properties to maintain stability and functionality. The versatility of organic binders in adapting to subsea challenges positions them as crucial components in the oil and gas sector's subsea operations.

Raw material prices, particularly those of organic compounds used in binder formulations, play a role in shaping the Subsea Organic Binders Market. Fluctuations in the costs of these raw materials impact the production costs and pricing of organic binders. Companies in the market must implement effective supply chain strategies and cost management practices to navigate these raw material price dynamics.

Leave a Comment