Market Share

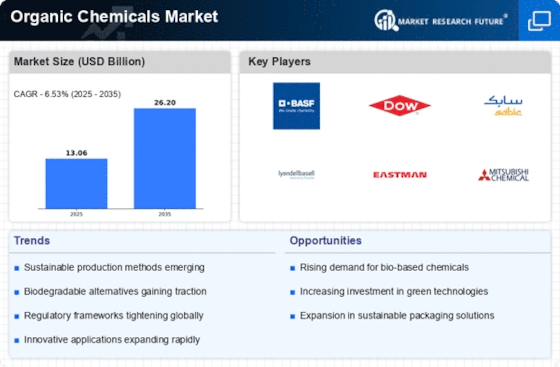

Organic Chemicals Market Share Analysis

Market share positioning strategies are essential for firms to establish a unique brand, draw in clients, and keep a competitive advantage in the highly competitive Organic Chemicals Market. The following guidelines clarify the main tactics used by market participants to proactively position themselves in this dynamic market: Product Innovation and Differentiation: Using innovation and differentiation to set items apart is a key tactic. To differentiate themselves in the market, businesses spend money on R&D to produce original formulas, innovative chemical processes, and environmentally responsible substitutes. Emphasis on Chemical Specialties: It is a wise strategic move to focus on producing specialized or specialty chemicals. Businesses can become authorities in their domain, serving specialized applications and building a loyal clientele by focusing on particular chemical categories. Sustainability and Green Chemistry: A popular approach is to use the concepts of sustainability and green chemistry. Businesses that implement sustainable methods and present themselves as environmentally conscious win over customers and satisfy the rising demand for green products. Adoption of Bio-based Chemicals: Using bio-based chemicals is part of the market positioning strategy. Businesses that create organic alternatives and use renewable feedstocks are in line with customer demands for green products, which helps them gain market share. Strategic Collaborations and Partnerships: Establishing these kind of relationships is essential. Companies may get access to new technology, pool resources, and strengthen their market position by forming mutually advantageous alliances with other industry participants. Global Expansion Initiatives: Increasing your geographic reach is a calculated tactic to reach a wider audience. Businesses may access growing markets, diversify their clientele, and reduce the risks brought on by regional economic swings by proactively entering new nations or areas. Customer-Centric strategy: For market share positioning, a customer-centric strategy must be used. Businesses may cultivate brand loyalty and obtain a competitive edge by comprehending and meeting the demands of their customers, offering superior customer service, and fostering strong connections.

Leave a Comment