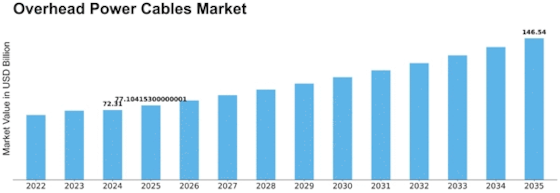

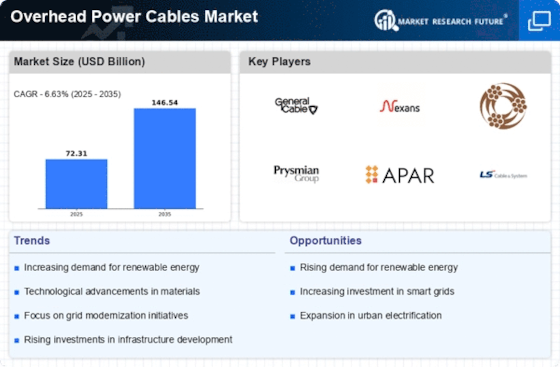

Overhead Power Cables Size

Overhead Power Cables Market Growth Projections and Opportunities

The Overhead Power Cables market is affected by technical advances, infrastructural development, and the worldwide drive for renewable energy. Technological advances in materials and design shape market dynamics. High-performance materials like aluminum and composites have been used to improve overhead power line efficiency and durability. Advanced conductor technologies like high-temperature superconductors boost power transmission capacity and minimize energy losses, driving industry growth.

Infrastructure development greatly affects overhead power wire demand. Reliable and efficient overhead power cables are needed as countries modernize and extend their power transmission and distribution networks. Rapid urbanization and industrialization increase electricity consumption, requiring durable overhead power line infrastructure. Newer overhead wires are replacing older ones, improving grid dependability and reducing maintenance.

The global focus on renewable energy sources also shapes the overhead power cables industry. The electrical grid needs considerable transmission and distribution infrastructure to integrate renewable energy like wind and solar power. Overhead power lines, which can carry electricity vast distances, are essential to renewable energy initiatives. The global shift toward greener energy sources increases demand for overhead power lines that can carry power from far renewable energy plants to metropolitan areas.

Regulations and environmental concerns may affect market dynamics. To guarantee safety, dependability, and environmental sustainability, governments and regulatory agencies define power cable installation and operating requirements. Compliance with these rules influences market companies' design and production processes. Eco-friendly overhead power cables address recyclability and decreased environmental effect during manufacture and disposal due to the growing focus on environmental sustainability.

Competition in the overhead power cable industry also matters. To stay ahead, industry leaders do ongoing research and development. This has led to new cable designs, insulating materials, and conductor technologies. Customization, extensive service offerings, and strategic collaborations add to the competitive environment, giving end-users many alternatives and solutions to meet their needs.

Finally, technical advances, infrastructural development, the worldwide drive for renewable energy, regulatory frameworks, and competitive factors influence the Overhead Power Cables market. As urbanization, industrialization, and the switch to cleaner energy sources increase global electricity demand, the overhead power cables market is expected to evolve, focusing on efficiency, sustainability, and technological innovation.

Leave a Comment