Rising Prevalence of Respiratory Disorders

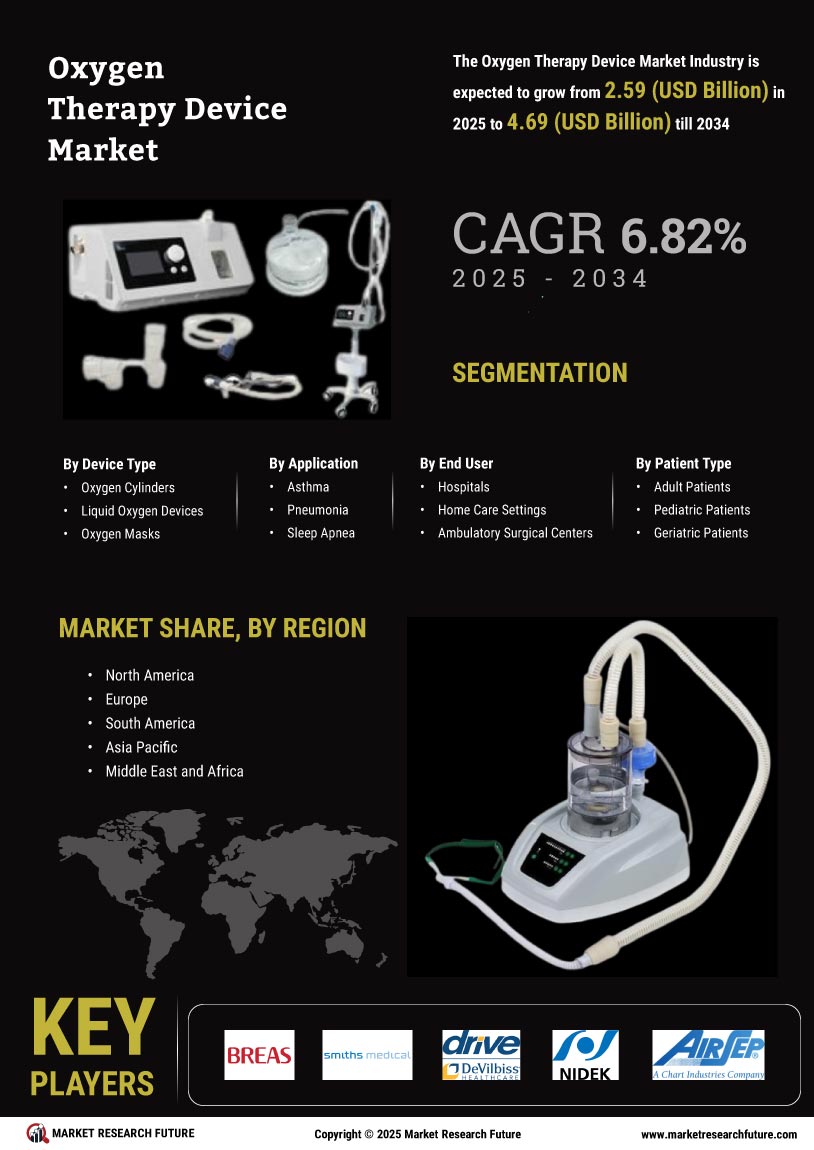

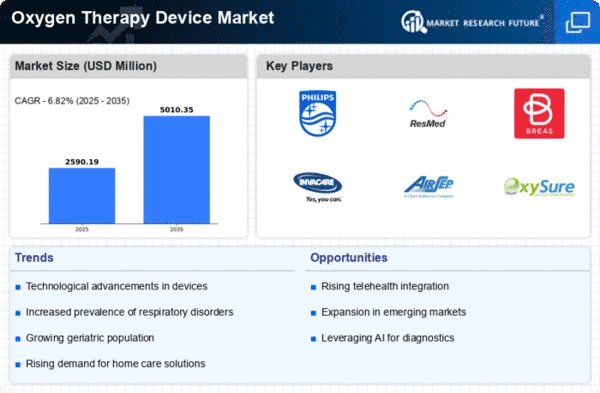

The Global Oxygen Therapy Device Market Industry is experiencing growth due to the increasing prevalence of respiratory disorders such as chronic obstructive pulmonary disease and asthma. According to health statistics, respiratory diseases are among the leading causes of morbidity and mortality worldwide. This trend is likely to drive the demand for oxygen therapy devices, as patients require supplemental oxygen to manage their conditions effectively. The market is projected to reach 3.27 USD Billion in 2024, indicating a robust need for innovative therapeutic solutions. As awareness of respiratory health continues to rise, the Global Oxygen Therapy Device Market Industry is expected to expand significantly.

Regulatory Support and Reimbursement Policies

Regulatory support and favorable reimbursement policies are crucial factors propelling the Global Oxygen Therapy Device Market Industry. Governments and health authorities are implementing regulations that facilitate the approval and distribution of oxygen therapy devices, ensuring they meet safety and efficacy standards. Additionally, reimbursement policies that cover the costs of these devices encourage healthcare providers to prescribe them more frequently. This supportive regulatory environment is likely to enhance patient access to oxygen therapy, thereby driving market growth. As the industry evolves, continued regulatory support will be essential for sustaining the momentum of the Global Oxygen Therapy Device Market.

Technological Advancements in Oxygen Therapy Devices

Technological innovations play a pivotal role in the Global Oxygen Therapy Device Market Industry. The introduction of portable oxygen concentrators and advanced delivery systems enhances patient mobility and comfort. These devices are designed to provide precise oxygen delivery, improving patient outcomes. Moreover, advancements in telemedicine and remote monitoring technologies allow healthcare providers to track patient progress in real-time. This integration of technology not only enhances the efficacy of oxygen therapy but also contributes to the overall growth of the market, which is anticipated to reach 5 USD Billion by 2035. The ongoing development of user-friendly devices is likely to attract a broader patient demographic.

Aging Population and Increased Healthcare Expenditure

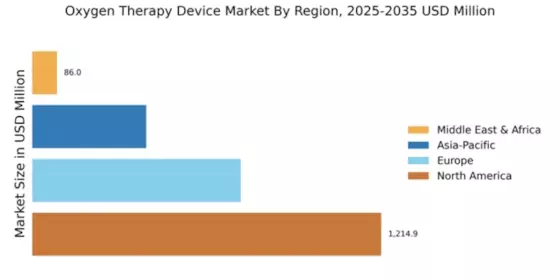

The aging population is a significant driver of the Global Oxygen Therapy Device Market Industry. As individuals age, the likelihood of developing respiratory conditions increases, leading to a higher demand for oxygen therapy. Additionally, rising healthcare expenditure globally facilitates access to advanced medical technologies, including oxygen therapy devices. Governments and healthcare systems are investing in better healthcare infrastructure, which supports the adoption of these devices. The market is expected to grow at a CAGR of 3.94% from 2025 to 2035, reflecting the increasing need for effective respiratory care solutions among the elderly population.

Growing Awareness and Education on Respiratory Health

Increased awareness and education regarding respiratory health significantly influence the Global Oxygen Therapy Device Market Industry. Public health campaigns and educational initiatives are fostering a better understanding of respiratory diseases and the importance of oxygen therapy. This heightened awareness encourages individuals to seek medical advice and treatment, thereby driving demand for oxygen therapy devices. Healthcare professionals are also emphasizing the role of oxygen therapy in managing chronic respiratory conditions, which further supports market growth. As awareness continues to expand, the Global Oxygen Therapy Device Market Industry is poised for substantial development in the coming years.