Packaging Laminates Size

Packaging Laminates Market Growth Projections and Opportunities

The Packaging Laminates Market is influenced by a myriad of market factors that collectively shape its dynamics and growth trajectory. One of the primary drivers is the increasing demand for flexible packaging solutions across various industries. Packaging laminates, known for their versatility, barrier properties, and cost-effectiveness, cater to the evolving needs of the packaging industry. The flexibility of laminates allows for the creation of pouches, sachets, and wraps, addressing consumer preferences for convenience and on-the-go packaging.

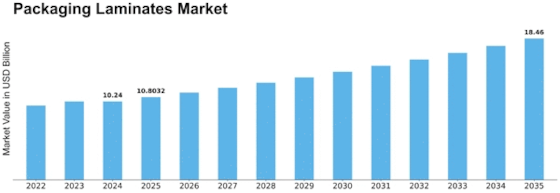

The global Packaging Laminates market is expected to register a CAGR of 5.50% during the forecast period and is estimated to reach USD 9.71 billion by 2032.

Changing consumer preferences and lifestyles significantly impact the Packaging Laminates Market. As consumers seek products with extended shelf life, enhanced visual appeal, and environmental sustainability, laminates emerge as a preferred choice for packaging. The ability to incorporate vibrant graphics, provide product protection, and offer convenience in terms of resealability contributes to the growing popularity of packaging laminates among brand owners and consumers alike.

Technological advancements play a crucial role in shaping the market landscape of packaging laminates. Continuous innovation in materials, printing technologies, and lamination processes leads to the development of high-performance laminates. The incorporation of features such as enhanced barrier properties, antimicrobial coatings, and smart packaging technologies expands the application scope of packaging laminates across industries, including food and beverage, pharmaceuticals, and personal care.

Sustainability considerations are integral to the Packaging Laminates Market. As environmental awareness grows, there is an increasing emphasis on developing eco-friendly packaging solutions. Manufacturers are responding by exploring and adopting sustainable materials, recyclable laminates, and eco-conscious printing technologies. The push toward circular economy principles influences the entire life cycle of packaging laminates, from raw material sourcing to end-of-life disposal.

Regulatory factors significantly influence the market dynamics of packaging laminates. Compliance with regulations related to food safety, product labeling, and environmental impact is crucial for manufacturers. Regulatory bodies set guidelines to ensure that packaging laminates meet safety standards, provide accurate information to consumers, and adhere to environmental sustainability practices. Adherence to these regulations is not only a legal requirement but also essential for building trust among consumers and stakeholders.

Cost considerations are another key factor in the Packaging Laminates Market. While laminates offer numerous advantages, including product protection and branding opportunities, manufacturers need to balance these benefits with cost-effectiveness. The cost of raw materials, manufacturing processes, and printing technologies directly impacts the overall pricing of packaging laminates. Striking the right balance between quality and cost is essential to remain competitive in the market.

Market factors are also shaped by the rising prevalence of e-commerce. The growth of online retail has led to an increased demand for packaging solutions that provide product protection during shipping and handling. Packaging laminates, with their ability to offer barrier properties and resistance to external elements, play a vital role in ensuring the integrity of products during the e-commerce supply chain.

Consumer education and awareness contribute to the market dynamics of packaging laminates. As consumers become more informed about the environmental impact of packaging materials, there is a growing demand for transparent and eco-friendly packaging solutions. Manufacturers that communicate the sustainability features of their packaging laminates effectively are likely to gain favor among environmentally conscious consumers.

Leave a Comment