Packaging Machinery Size

Packaging Machinery Market Growth Projections and Opportunities

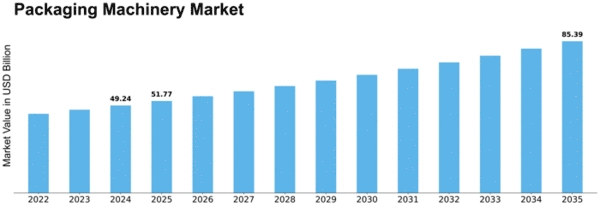

Influences on the Packaging Machinery Market encompass a variety of factors that collectively shape its dynamics and growth trajectory. The increasing demand for automation in packaging solutions across different industries is one of the essential drivers of this market. This has made the adoption of packaging machinery an important strategy as businesses aim to become efficient and cost-effective in their production processes. In 2022, the packaging machinery market size was estimated at $43.9 billion in US dollars (USD). By 2032, it is expected that the Packaging Machinery industry will grow from USD 46.5 billion in 2023 to USD 73.54 Billion with a CAGR of 5.90%. Additionally, the global focus on sustainability has had profound effects on the world's packaging equipment business. A growing number of environmentally conscious consumers have raised demand for eco-friendly packaging equipment while awareness of environmental issues grows among communities worldwide. Today, manufacturers are designing machines that reduce waste through improved materials optimization and recycling support. Moreover, increased consumer preferences diversity and product diversification have led to the growth of flexible packaging solutions demand. For example, there is currently a high demand for packing equipment that can handle all forms of packing, including different sizes and shapes, in most other emerging markets today. The technological landscape has also played an integral role in shaping the global market for packaging machinery. New ideas like smart package tools which come with sensors/UoT capabilities are beginning to be popular among users nowadays, too; they allow real-time monitoring during production operations/predictive maintenance/improve overall machine productivity level wise efficiency levels or OEEs since they offer far better insights into what really happens within manufacturing plants than ever before. As Industry 4.0 technologies take hold, smart technology incorporation into packing devices will likely speed up, thereby making it possible for makers to achieve more control over their processes while gaining greater visibility over them. Additionally, globalization and international trade dynamics also have a major impact on the packaging machinery market. Packaging solutions that conform to international standards and regulations are required by businesses that are now operating beyond their domestic markets. Companies' need to comply with different packaging requirements in different countries has led to an increase in demand for packaging machines. Therefore, cost is one of the main factors companies consider when buying a packaging machine. Although automated packing machines can save costs in the long term, the initial investment might be huge. Budget constraints may prevent small and medium-sized firms from adopting modern packing technologies. Regulatory elements are another key driver of the packaging machinery market's shape. There are strict regulations around the world governing materials used for packaging, safety standards, and waste disposal methods. In order to make sure that their products comply with industry norms and adhere to these rules, manufacturers should constantly monitor regulatory changes.

Leave a Comment