Market Trends

Key Emerging Trends in the Paper Packaging Market

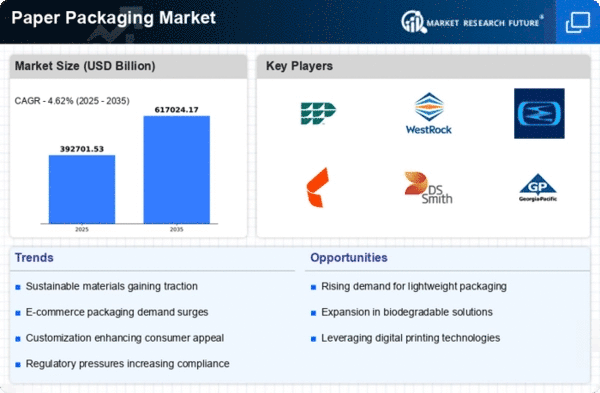

The paper packaging market is experiencing notable trends influenced by various factors such as sustainability initiatives, technological advancements, changing consumer preferences, and industry dynamics. Paper packaging, derived from renewable and biodegradable materials such as wood pulp, is widely used for packaging various consumer goods, including food and beverages, cosmetics, pharmaceuticals, and household products.

One significant trend in the paper packaging market is the increasing demand for sustainable packaging solutions that reduce environmental impact and promote recycling. With growing awareness of plastic pollution and the need to minimize carbon emissions, there is a rising preference for paper packaging made from recycled materials or sourced from responsibly managed forests. Manufacturers are responding to this trend by offering eco-friendly paper packaging options that maintain the same functionality and performance as conventional packaging while reducing reliance on virgin fibers and minimizing waste generation throughout the packaging lifecycle.

Moreover, technological advancements are driving innovation and adoption of advanced paper packaging designs and functionalities that offer superior performance, durability, and versatility. Innovations such as barrier coatings, moisture-resistant treatments, and heat-sealable properties enhance the functionality and shelf life of paper packaging, making it suitable for a wide range of applications, including food packaging, industrial packaging, and specialty packaging. Additionally, advancements in printing technologies enable high-quality graphics, vibrant colors, and customized branding options to enhance product visibility and consumer engagement for packaged goods.

Furthermore, customization and personalization are emerging trends in the paper packaging market as companies seek to differentiate their products and enhance brand recognition. Manufacturers are offering a wide range of customization options, including printed logos, promotional messages, and product information, to meet the specific branding and marketing needs of customers across various industries. Customized paper packaging not only serves functional purposes such as product protection and labeling but also serves as effective marketing tools to attract consumers and build brand loyalty. The global market for paper packaging has been classified based on type, level of packaging, and end-user industry, and region. On the basis of type, the paper packaging market is divided into corrugated boxes, boxboard or paperboard cartons, paper bags and sacks and paper pouches

The rise of e-commerce and omni-channel retailing is also driving demand for paper packaging solutions that can withstand the rigors of online shipping and fulfillment operations. With the exponential growth of online shopping and direct-to-consumer distribution models, there is a growing need for robust and sustainable packaging solutions to protect goods during transit and minimize damage. Paper packaging materials such as corrugated boxes, paperboard cartons, and paper-based void fill offer advantages such as strength, cushioning, and recyclability, making them ideal choices for e-commerce packaging applications.

Supply chain resilience and safety have become critical considerations for businesses in the wake of global disruptions such as the COVID-19 pandemic. Paper packaging plays a vital role in ensuring the safe and efficient transport of essential goods and materials across various industries, including food and beverages, healthcare, and consumer goods. As companies strive to maintain high standards of hygiene and product safety, the demand for reliable and sustainable paper packaging solutions with food-grade certifications and barrier properties is expected to remain strong.

Leave a Comment