- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

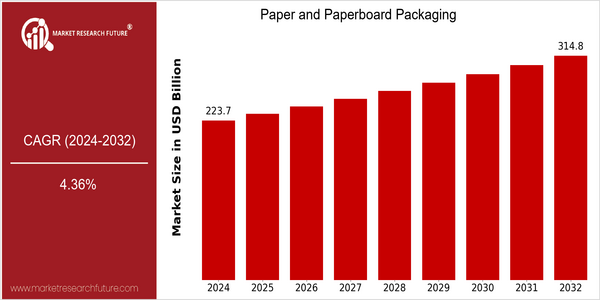

| Year | Value |

|---|---|

| 2024 | USD 223.69 Billion |

| 2032 | USD 314.76 Billion |

| CAGR (2024-2032) | 4.36 % |

Note – Market size depicts the revenue generated over the financial year

The global paper and paperboard packaging market is poised for significant growth, with a current market size of USD 223.69 billion in 2024, projected to reach USD 314.76 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of 4.36% over the forecast period from 2024 to 2032. The increasing demand for sustainable packaging solutions, driven by heightened environmental awareness and regulatory pressures, is a key factor propelling this market forward. As consumers and businesses alike prioritize eco-friendly materials, the shift from plastic to paper-based alternatives is becoming increasingly pronounced. Technological advancements in production processes and innovations in material science are also contributing to the market's expansion. Companies are investing in research and development to enhance the performance and recyclability of paper products, which is attracting a broader customer base. Notable players in the industry, such as International Paper, WestRock, and Smurfit Kappa, are actively pursuing strategic initiatives, including partnerships and investments in sustainable technologies, to strengthen their market positions. For instance, recent product launches focusing on biodegradable and compostable packaging solutions underscore the industry's commitment to sustainability, further driving growth in the paper and paperboard packaging sector.

Regional Market Size

Regional Deep Dive

The Paper and Paperboard Packaging Market is experiencing dynamic growth across various regions, driven by increasing demand for sustainable packaging solutions and the rise of e-commerce. In North America, the market is characterized by a strong emphasis on recycling and eco-friendly materials, while Europe showcases stringent regulations promoting sustainable practices. The Asia-Pacific region is witnessing rapid industrialization and urbanization, leading to heightened demand for packaging solutions. Meanwhile, the Middle East and Africa are gradually adopting modern packaging technologies, and Latin America is focusing on improving its supply chain efficiency. Each region presents unique opportunities and challenges shaped by local economic conditions, cultural preferences, and regulatory frameworks.

Europe

- The European Union's Green Deal aims to make Europe the first climate-neutral continent by 2050, which is driving innovation in biodegradable and recyclable paper products, with companies like Smurfit Kappa leading the charge.

- The rise of e-commerce in Europe has led to increased demand for customized packaging solutions, prompting companies to invest in advanced printing technologies and automation to enhance efficiency and reduce waste.

Asia Pacific

- China's commitment to reducing plastic waste has led to a surge in demand for paper and paperboard packaging, with major players like Nine Dragons Paper Holdings expanding their production capacities to meet this growing need.

- India's rapid urbanization and increasing disposable incomes are driving the demand for packaged goods, leading to a rise in paper packaging solutions, supported by government initiatives promoting sustainable practices.

Latin America

- Brazil is witnessing a shift towards sustainable packaging, with companies like Klabin investing in renewable resources and innovative packaging solutions to meet both local and international market demands.

- The region's increasing focus on reducing deforestation and promoting sustainable forestry practices is influencing the paper and paperboard packaging market, with government programs supporting reforestation and responsible sourcing.

North America

- The U.S. has seen a significant shift towards sustainable packaging, with companies like WestRock and International Paper investing heavily in eco-friendly materials and processes to meet consumer demand for greener options.

- Recent regulatory changes in California, such as the implementation of the California Circular Economy and Plastic Pollution Reduction Act, are pushing manufacturers to adopt recyclable and compostable packaging solutions, thereby influencing market dynamics.

Middle East And Africa

- The UAE is investing in advanced packaging technologies as part of its Vision 2021 initiative, which aims to enhance sustainability and innovation in various sectors, including packaging.

- South Africa's growing retail sector is pushing for more sustainable packaging solutions, with local companies like Mondi Group focusing on developing eco-friendly paper products to cater to this demand.

Did You Know?

“Approximately 70% of paper and paperboard packaging is recycled in the U.S., making it one of the most recycled materials in the country.” — American Forest & Paper Association

Segmental Market Size

The Paper and Paperboard Packaging Market is currently experiencing stable growth, driven by increasing consumer demand for sustainable packaging solutions. Key factors propelling this segment include heightened environmental awareness among consumers, leading to a preference for recyclable materials, and regulatory policies that promote the reduction of plastic usage. Additionally, advancements in production technologies enhance the efficiency and quality of paper-based packaging, further stimulating demand. Currently, the market is in a mature adoption stage, with companies like Smurfit Kappa and WestRock leading the way in innovative packaging solutions. Primary applications include food and beverage packaging, where brands like Coca-Cola and Unilever are shifting towards paper-based alternatives to meet sustainability goals. Macro trends such as government mandates on single-use plastics and the global push for circular economy practices are accelerating growth in this segment. Technologies such as digital printing and smart packaging are also shaping the evolution of paper and paperboard packaging, enabling customization and improved supply chain efficiency.

Future Outlook

The Paper and Paperboard Packaging market is poised for significant growth from 2024 to 2032, with a projected market value increase from $223.69 billion to $314.76 billion, reflecting a compound annual growth rate (CAGR) of 4.36%. This growth trajectory is underpinned by rising consumer demand for sustainable packaging solutions, as businesses increasingly prioritize eco-friendly materials in response to stringent environmental regulations and shifting consumer preferences. By 2032, it is anticipated that sustainable paper and paperboard products will account for over 60% of the market, driven by innovations in recycling technologies and the development of biodegradable materials. Key technological advancements, such as digital printing and smart packaging, are expected to further enhance the functionality and appeal of paper and paperboard packaging. These innovations not only improve the aesthetic and branding capabilities of packaging but also facilitate better supply chain management through enhanced tracking and information dissemination. Additionally, the ongoing trend towards e-commerce is likely to bolster demand for protective packaging solutions, with paper and paperboard materials being favored for their lightweight and recyclable properties. As the market evolves, stakeholders must remain agile, adapting to emerging trends and consumer expectations to capitalize on the growth opportunities that lie ahead.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 213.04 Billion |

| Growth Rate | 4.36% (2024-2032) |

Paper Paperboard Packaging Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.