Paper Paperboard Packaging Market Summary

As per Market Research Future analysis, The Global Paper and Paperboard Packaging Size was estimated at 223.5 USD Billion in 2024. The paper and paperboard packaging industry is projected to grow from 233.1 USD Billion in 2025 to 357.1 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Global Paper and Paperboard Packaging is currently experiencing robust growth driven by sustainability and e-commerce trends.

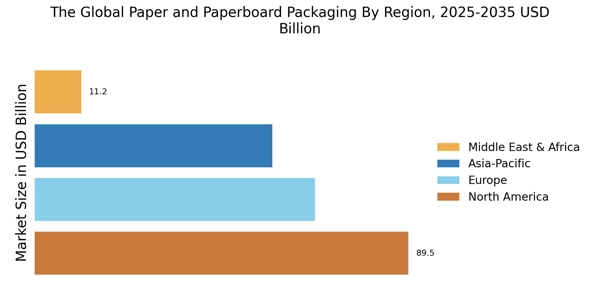

- North America remains the largest market for paper and paperboard packaging, reflecting a strong demand for sustainable solutions.

- Asia-Pacific is identified as the fastest-growing region, propelled by increasing urbanization and consumer spending.

- Corrugated boxes dominate the market as the largest segment, while paper bags are emerging as the fastest-growing segment due to rising eco-consciousness.

- Key market drivers include sustainability initiatives and the growth of e-commerce, which are reshaping consumer preferences and regulatory compliance.

Market Size & Forecast

| 2024 Market Size | 223.5 (USD Billion) |

| 2035 Market Size | 357.1 (USD Billion) |

| CAGR (2025 - 2035) | 4.3% |

Major Players

International Paper (USA), WestRock (USA), Smurfit Kappa (Ireland), Mondi Group (UK), DS Smith (UK), Stora Enso (Finland), Oji Holdings (Japan), Nine Dragons Paper (China), Packaging Corporation of America (USA), KapStone Paper (USA)