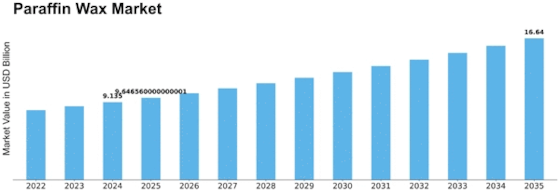

Paraffin Wax Size

Paraffin Wax Market Growth Projections and Opportunities

The Paraffin Wax market is influenced by various market factors that play a crucial role in shaping its dynamics. One of the primary factors impacting this market is the fluctuating demand from end-use industries. Paraffin wax finds applications in diverse sectors such as candles, packaging, cosmetics, and pharmaceuticals. Therefore, any shifts in the demand for products in these industries directly affect the demand for paraffin wax.

Moreover, the availability and pricing of raw materials, specifically crude oil, significantly impact the paraffin wax market. Since paraffin wax is derived from petroleum, any fluctuations in crude oil prices can have a direct impact on the production cost of paraffin wax. This, in turn, affects the pricing and profitability of paraffin wax manufacturers.

Regulatory factors also play a pivotal role in shaping the paraffin wax market landscape. Stringent regulations related to environmental concerns and product quality standards can impact the production processes of paraffin wax manufacturers. Compliance with these regulations not only influences the cost structure but also affects the market entry of new players.

Global economic conditions and geopolitical factors can also impact the paraffin wax market. Economic downturns can lead to reduced consumer spending, affecting industries like candles and cosmetics, which are significant consumers of paraffin wax. Additionally, geopolitical tensions and trade policies can influence the global supply chain, affecting the availability and pricing of paraffin wax in different regions.

Technological advancements also contribute to the market dynamics of paraffin wax. Innovations in production processes, such as the development of advanced refining technologies, can enhance the efficiency and quality of paraffin wax. This, in turn, influences the competitiveness of manufacturers and their ability to meet the evolving demands of end-users.

Environmental awareness and sustainability considerations are increasingly becoming significant factors in the paraffin wax market. As consumers and industries prioritize eco-friendly alternatives, there is a growing demand for sustainable and renewable sources of wax. This shift in preferences is encouraging manufacturers to explore and invest in alternative sources of wax, such as plant-based or synthetic alternatives.

Market competition is another crucial factor shaping the paraffin wax market. The presence of key players, market share distribution, and competitive strategies adopted by manufacturers influence the overall market dynamics. Mergers and acquisitions, partnerships, and strategic alliances are common strategies employed by companies to strengthen their market position and expand their product portfolio

Leave a Comment