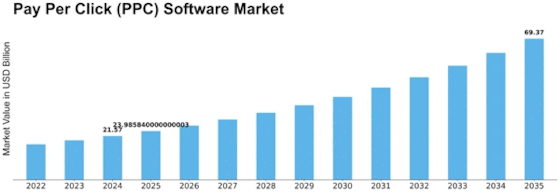

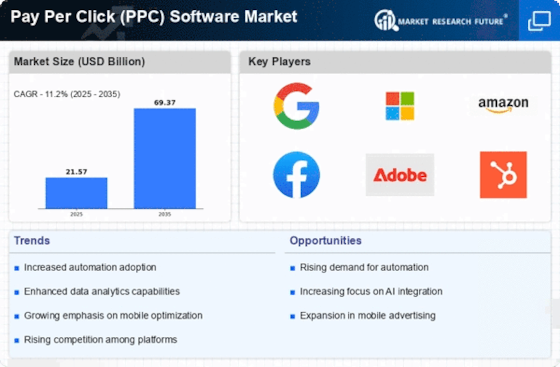

Pay Per Click Ppc Software Size

Pay Per Click (PPC) Software Market Growth Projections and Opportunities

The PPC Software industry has complex market dynamics which are shaped by the changing outlook of online advertising, digital marketing strategies and the hunt for more efficient methods to manage pay-per-click campaigns. Consequently, PPC software has become an essential tool for businesses and marketers that want to optimize their online presence, drive traffic specifically targeted individuals and achieve conversions and revenues that can be measured. Essentially, this market is characterized by a few catalysts that reflect the dynamism of advertisers’ demands as well as increasing complexities in online ad platforms.

One major driver behind these dynamic changes in the market landscape of Pay Per Click (PPC) Software is the growing importance of digital advertising in overall marketing mix. In response to businesses’ increasing budgets towards online media spend — for instance via Google Ads or Bing Ads — it has become necessary to have highly advanced PPC management tools. It allows advertisers to create, monitor and optimize campaigns ensuring their ad spends go where yield on investments is highest. This shift from traditional media channels to online platforms creates demand for greater feature-richness in PPC software.

Another significant factor affecting the market dynamics of PPC Software is its relation with evolving digital marketing strategies and the rising influence of data-driven decision-making. Advertisers are relying more on data analytics, performance metrics, and audience insights when planning PPC campaigns. On top of this robust analytic capabilities provided by a good PPC software package allows you to review key performance indicators (KPIs), analyze campaign metrics and make data driven optimizations. To advertisers who wish to narrow targeting down more tightly, improve ads further or do better at large campaign level – getting actionable insights out of campaign data becomes very important.

Additionally, there is a huge demand for automation as well as efficiency in managing PPC campaigns; hence directly affecting the market dynamics herein described. Automation through features such as bid management, keyword selection or ad scheduling is enabled by use of PPC software. It not only saves time but also brings more precision to the table, enabling marketers to dynamically adjust their ads according to changes in competition or market demands. The integration of AI (Artificial Intelligence) and ML (Machine Learning) technologies in PPC software has bolstered its automation capabilities that include predictive analytics, audience targeting refinement and real-time adjustments for optimizing campaign performance.

Leave a Comment