Regulatory Support

Regulatory frameworks are evolving to support the Global Peer To Peer Lending Market Industry, which may enhance its credibility and attract more investors. Governments are increasingly recognizing the importance of peer to peer lending in promoting financial inclusion and economic growth. For example, some jurisdictions are implementing regulations that protect both lenders and borrowers, thereby fostering a safer lending environment. This regulatory support could potentially lead to a compound annual growth rate of 21.6% from 2025 to 2035, as more platforms emerge and existing ones expand their operations in compliance with new guidelines.

Global Economic Growth

The Global Peer To Peer Lending Market Industry is likely to benefit from overall economic growth, which tends to increase disposable income and consumer spending. As economies recover and expand, individuals and businesses may seek additional funding sources to capitalize on new opportunities. This trend is particularly relevant in emerging markets where traditional banking services are limited. The anticipated growth in the global economy could correlate with a significant rise in peer to peer lending activities, further propelling the market towards its projected size of 218.7 USD Billion in 2024. Economic stability often encourages investment in innovative financial solutions, including peer to peer lending.

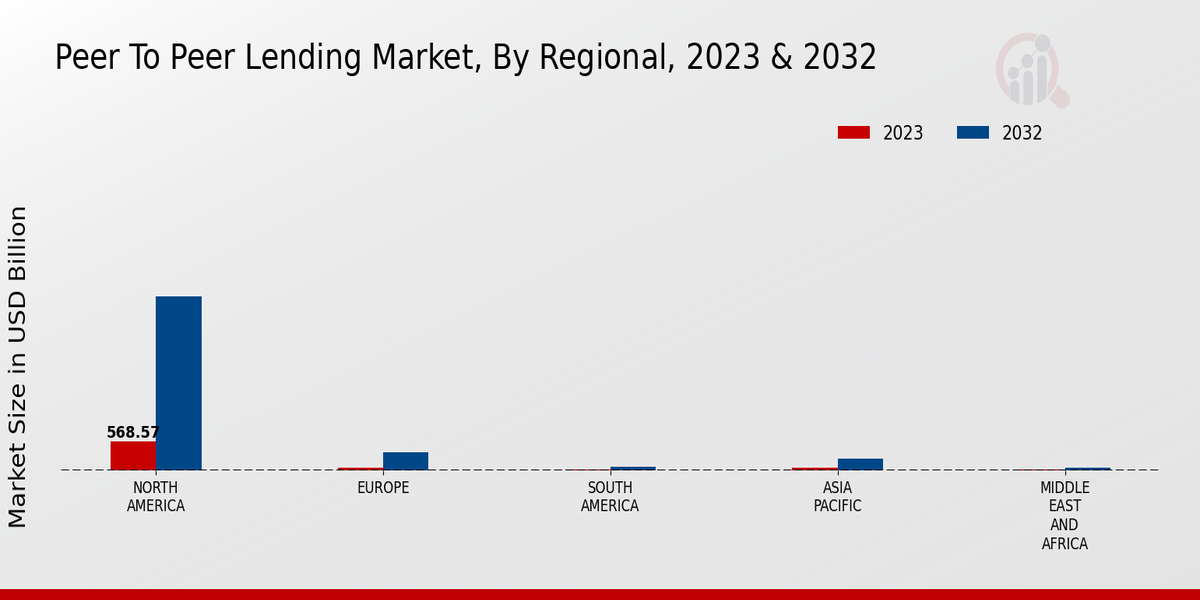

Market Growth Projections

The Global Peer To Peer Lending Market Industry is poised for remarkable growth, with projections indicating a market size of 218.7 USD Billion in 2024 and an astonishing 1879.6 USD Billion by 2035. This trajectory suggests a compound annual growth rate of 21.6% from 2025 to 2035, highlighting the increasing acceptance and reliance on peer to peer lending as a viable financial solution. The growth is driven by various factors, including technological advancements, regulatory support, and rising consumer demand for alternative financing. These projections underscore the potential of the industry to reshape the financial landscape globally.

Technological Advancements

The Global Peer To Peer Lending Market Industry is experiencing a surge due to rapid technological advancements. Innovations in fintech, such as blockchain and artificial intelligence, are streamlining the lending process, enhancing security, and improving user experience. For instance, platforms are utilizing machine learning algorithms to assess creditworthiness more accurately, which could lead to a broader customer base. As technology continues to evolve, it is likely that the market will expand significantly, with projections indicating a market size of 218.7 USD Billion in 2024. This technological integration not only increases efficiency but also fosters trust among users, thereby driving growth.

Consumer Awareness and Education

Consumer awareness and education regarding peer to peer lending are crucial drivers for the Global Peer To Peer Lending Market Industry. As more individuals become informed about the benefits and risks associated with this financing model, they are more likely to engage with peer to peer platforms. Educational initiatives, such as workshops and online resources, are helping demystify the lending process and build trust among potential users. This increased awareness could lead to a larger market share, as evidenced by the projected growth to 1879.6 USD Billion by 2035. A well-informed consumer base is essential for the sustainability and expansion of the industry.

Increasing Demand for Alternative Financing

The Global Peer To Peer Lending Market Industry is witnessing a growing demand for alternative financing solutions. Traditional banking systems often impose stringent lending criteria, which can exclude many potential borrowers. Peer to peer lending platforms offer a more accessible option, catering to individuals and small businesses seeking loans without the bureaucratic hurdles. This shift towards alternative financing is reflected in the projected market growth, with an expected size of 1879.6 USD Billion by 2035. As more consumers and businesses recognize the benefits of peer to peer lending, the industry is likely to see a substantial increase in participation and investment.