Market Analysis

In-depth Analysis of Perishable Goods Transportation Market Industry Landscape

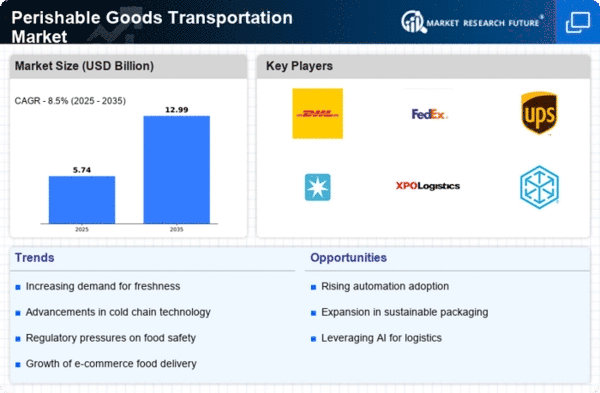

The market dynamics of perishable goods transportation are experiencing significant changes influenced by a combination of factors that impact both the logistics and supply chain sectors. Perishable goods, including fresh produce, pharmaceuticals, and dairy products, require specialized transportation to maintain their quality and freshness throughout the supply chain. The market dynamics are characterized by advancements in cold chain technology, regulatory compliance, global trade patterns, and the increasing demand for efficient and reliable perishable goods transportation solutions.

Advancements in cold chain technology play a crucial role in shaping the dynamic nature of the perishable goods transportation market. The development of state-of-the-art refrigeration and temperature-controlled systems ensures that perishable goods remain at optimal conditions during transportation. Innovations in monitoring and tracking technologies further enhance visibility into the cold chain, allowing for real-time data on temperature, humidity, and location. These technological advancements not only improve the efficiency and reliability of perishable goods transportation but also influence the market dynamics by setting higher standards for quality and safety throughout the supply chain.

Regulatory compliance is a significant driver of market dynamics in the perishable goods transportation sector. Strict regulations govern the transportation of perishable goods, especially in the food and pharmaceutical industries, to ensure consumer safety and product integrity. Adherence to temperature requirements, documentation standards, and hygiene practices is essential. The evolving regulatory landscape, with an increasing emphasis on traceability and transparency, shapes the market dynamics by requiring transportation providers to invest in compliance measures and technologies to meet industry standards.

Global trade patterns significantly impact the market dynamics of perishable goods transportation. With the globalization of supply chains, perishable goods are transported across borders, connecting producers to consumers worldwide. Changes in trade agreements, geopolitical factors, and shifts in consumer preferences for exotic or seasonal products influence the demand for perishable goods transportation services. The ability to efficiently transport goods over long distances while maintaining quality becomes a crucial aspect of market dynamics in response to the global nature of perishable goods trade.

The increasing demand for efficient and reliable perishable goods transportation solutions is a driving force behind market dynamics. Consumers expect a steady supply of fresh produce, pharmaceuticals, and other perishable items, regardless of geographical locations and seasonal variations. This demand puts pressure on logistics providers to optimize transportation routes, minimize transit times, and invest in technologies that ensure the preservation of product quality. The competitive landscape of the perishable goods transportation market is shaped by the ability of providers to meet these demands while adhering to safety and regulatory requirements.

Competition within the market fosters innovation and efficiency in perishable goods transportation. Logistics companies are continually striving to differentiate themselves by offering advanced cold chain solutions, incorporating sustainable practices, and optimizing last-mile delivery. Collaborations between transportation providers, technology companies, and stakeholders in the perishable goods supply chain contribute to ongoing research and development, driving innovation and influencing the competitive landscape of the market.

Socio-economic factors, including population growth, urbanization, and dietary preferences, contribute to the market dynamics of perishable goods transportation. As urban populations increase and consumer preferences shift towards fresh and diverse food options, the demand for efficient and reliable transportation of perishable goods rises. Economic trends, such as rising income levels, also impact the consumption patterns of perishable goods, shaping the overall market dynamics.

Leave a Comment