Market Share

Permanent Magnet Market Share Analysis

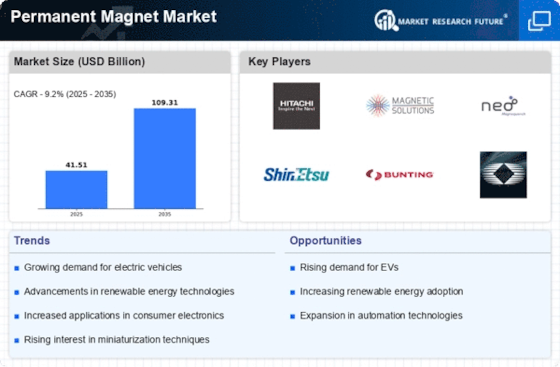

The Permanent Magnet Market, which is an ever-changing industry on the world of industrial scenes uses a wide range of market share positioning techniques to ensure that it maintains its competitive advantage. Companies operating within this sector make use of a very diverse variety of strategies to grow their presence and impact in the industry. A popular approach is differentiation, in which the firms strive to develop distinctive and advanced permanent magnet items that differentiate them from the competition. Spending in areas such as research and development can allow business entities to come up with proprietary technologies or design features that address specific customer needs, industry issues. This not only enables them to charge higher for their own unique products but also helps in establishing a strong brand position. One of the major market share positioning strategies is the cost leadership. In this strategy, firms seek to be low-cost producers of the permanent magnet. This entails streamlining the production, acquiring economies of scale and efficient supply chain management. Companies can encourage cost-conscious customers to patronize them by charging competitive prices and thus they gain a larger market share. On the other hand, it is very important to strike a balance in cost-cutting and preserving the product quality, as this can harmthe brand reputation. Market segmentation is defined as a strategy that aims at addressing specific customer segments with customized permanent magnet solutions. Companies assess the varying demands of the various industries and implementations including automobile, electronics, or renewable energy, to build products specific for different needs. It enables them to enter into the niche markets and secure a firm footing in segments where they can offer the most value. Knowing the specific needs of each segment allows companies to have a strong customer relations and gain a higher total market share. However, in the Permanent Magnet Market, cooperation and partnerships are indeed becoming a widespread phenomenon. While companies value strategic alliances with other industry players, the suppliers or research institutions for a number of reasons. Some of the benefits that can result from collaborative endeavors are shared resources, expertise and also knowledge which would promote creativity in a bid to help with quick market penetration. Partnerships can also allow access to the additional distribution outlets, increasing the exposure of permanent magnet products to a greater market. Global market share positioning strategy includes a geographic expansion wherein companies seek new regions and the and countries for revenues. One of the ways to diversify the customer base and increase independence from selected markets is by locating in emerging market or regions with no potential customers. This approach involves product customization to the specificities of various regions, compliance with local requirements and is focused on successful market entry through a relevant distribution system.

Leave a Comment