Market Analysis

In-depth Analysis of Personal Hygiene Market Industry Landscape

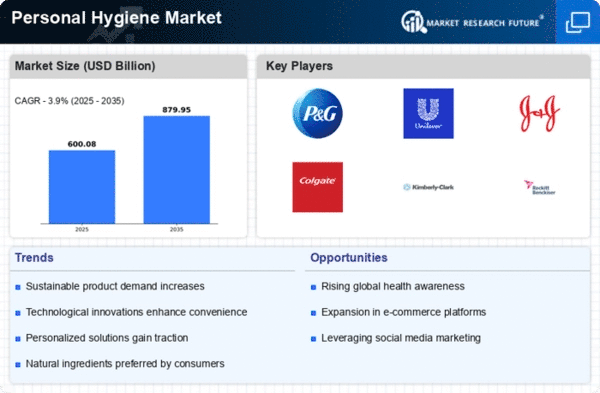

Purchaser conduct, innovative turns of events, and cultural patterns all impact the personal hygiene market. A proceeded with expansion popular for personal hygiene items has come about because of the developing consciousness of cleanliness and wellbeing, particularly during worldwide wellbeing emergencies like the Coronavirus pandemic. This pattern highlights the meaning of cleanliness rehearses in advancing generally speaking prosperity on a global scale. The market elements have been essentially adjusted by the Coronavirus pandemic, bringing about an expanded interest for personal hygiene items. This has made clients take on new ways of behaving and focus on neatness over prompt worries connected with the pandemic. Mechanical advances significantly affect the industry, impacting the production of creative definitions, shrewd innovations, and harmless to the ecosystem bundling, all of which improve usefulness and appeal to an extending customer looking for innovatively progressed arrangements. Because of urbanization and way of life changes, market elements are being impacted by the way that city inhabitants put a superior on private consideration and cleanliness. This has created a flood popular for an assortment of personal hygiene items, including oral and restorative arrangements. The appearance of electronic trade has altogether changed the retail climate concerning individual cleanliness items by giving shoppers the additional advantages of comfort and effortlessness in buying. Subsequently, customer execution available has been considerably influenced, considering that web-based stages offer shoppers direct admittance to a tremendous determination of items. Customers are dynamically embracing maintainable practices, as confirmed by the developing reception of eco-accommodating bundling, natural fixings, and cruelty free cycles. This pattern mirrors a greater cultural change towards dependable industrialism. The market elements are eminently affected by administrative consistence and security guidelines, which thus shape the improvement of enterprises, showcasing methodologies, shopper certainty, and assurance the quality and wellbeing of items. Maturing and other segment factors impact the interest for personal hygiene items. By taking care of different age gatherings, development and market division ensure a huge purchaser base. Customer decisions in the market are considerably affected by monetary elements, like value awareness and extra cash. This is particularly obvious during times of financial vulnerability, while buying choices and market patterns are significantly impacted. The interaction between market elements and brand dedication is significant, as well as the viability of showcasing procedures; laid out brands will generally develop customer trust and unwaveringness. Brands ceaselessly attempt to separate themselves from contenders and produce persevering through associations with purchasers. Purchasers who focus on eco-friendly items are drawn to brands that backer for maintainable obtainment, eco-accommodating drives, and the decrease of plastic waste. Such brands likewise measure up to cultural assumptions for capable business direct.

Leave a Comment