Top Industry Leaders in the Pervious Pavement Market

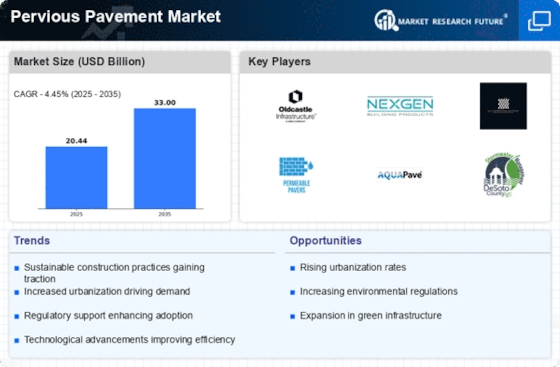

The pervious pavement market is fueled by rising urbanization, environmental concerns, and growing awareness of stormwater management solutions. The landscape is dynamic, with established players and innovative startups vying for market share. Let's delve into the competitive strategies, key factors, industry news, and recent developments shaping this market.

The pervious pavement market is fueled by rising urbanization, environmental concerns, and growing awareness of stormwater management solutions. The landscape is dynamic, with established players and innovative startups vying for market share. Let's delve into the competitive strategies, key factors, industry news, and recent developments shaping this market.

Competitive Strategies:

-

Product diversification: Leading players like BASF, Raffin Construction, and Sika are expanding their product portfolios beyond traditional pervious concrete to include porous asphalt, interlocking pavers, and grass pavers, catering to diverse application needs. -

Technological advancements: Innovation is key, with companies like PaveDrain focusing on developing high-strength, lightweight materials and optimized drainage systems for improved performance and cost-effectiveness. -

Sustainability emphasis: Sustainability is a key differentiator, with companies like UltraTech Cement and Chaney Enterprises highlighting the environmental benefits of pervious pavements, such as reduced heat island effect and improved water quality. -

Regional focus: Market leaders are tailoring their strategies to specific regions. LafargeHolcim, for instance, is actively involved in promoting pervious pavements in developing countries like India and China. -

Partnerships and acquisitions: Collaborations are becoming crucial. CRH partnered with Beeson Masonry to expand its pervious pavement offerings in the US, while Cemex acquired PaveMaster to strengthen its presence in the European market.

Factors Influencing Market Share:

-

Government regulations and incentives: Increasing regulations mandating sustainable stormwater management solutions in developed countries like the US and Europe are driving market growth. Governments are also offering tax breaks and subsidies to encourage pervious pavement adoption. -

Project-specific requirements: Large-scale infrastructure projects in sectors like airports, parking lots, and commercial developments are presenting lucrative opportunities for pervious pavement manufacturers. -

Cost competitiveness: While still higher than traditional pavements, the cost of pervious pavements is decreasing due to technological advancements and economies of scale, making them more attractive to budget-conscious projects. -

Environmental awareness and public demand: Growing public and investor awareness of environmental issues is creating a strong demand for sustainable solutions like pervious pavements.

Key Players

- Lafarge Holcim (Switzerland)

- Sika AG (Switzerland)

- Balfour Patty Plc (U.K.)

- Ultratech Cement Limited (India)

- Boral Limited (Australia)

- Chaney Enterprises (U.S)

- Raffin Construction Co (U.S)

- BASF SE (Germany)

- CRH Plc (Ireland)

- Cemex S. A. B de C.V (Mexico)

Recent Developments :

Mar 2023: The US Department of Transportation awards grants to several cities for pilot projects involving the use of pervious pavements in urban areas.

Apr 2023: A new pervious pavement material made from recycled plastic waste gains traction for its sustainability and cost-effectiveness.

May 2023: China unveils ambitious plans to invest in green infrastructure, including the use of pervious pavements in new construction projects.

Jun 2023: A global conference on pervious pavements attracts leading experts and industry stakeholders, further propelling the market forward.