Pharmaceutical Coating Equipment Size

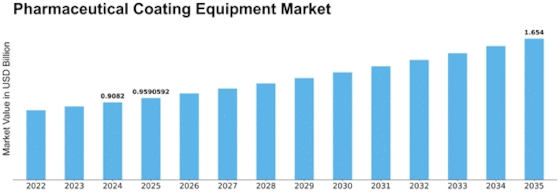

Pharmaceutical Coating Equipment Market Growth Projections and Opportunities

The Pharmaceutical Coating Equipment Market is influenced by a combination of factors that collectively shape its growth and dynamics. A primary driver is the constant evolution and expansion of the pharmaceutical industry, wherein coating equipment plays a critical role in the production of coated pharmaceutical products. Coating equipment is essential for applying protective or functional coatings to tablets, capsules, and other pharmaceutical dosage forms, enhancing drug stability, appearance, and palatability. The pharmaceutical industry's continuous efforts to improve drug delivery, dosage accuracy, and patient compliance contribute to the demand for advanced coating technologies and equipment.

Technological advancements in pharmaceutical coating equipment significantly impact market dynamics. Continuous research and development efforts focus on enhancing the efficiency, precision, and flexibility of coating processes. Innovations in coating formulations, spray systems, and automation technologies contribute to improved coating uniformity, reduced waste, and enhanced product quality. Advanced equipment also addresses challenges related to the coating of sensitive or complex formulations, providing pharmaceutical manufacturers with versatile solutions for various drug delivery needs.

The pharmaceutical industry's emphasis on quality, safety, and regulatory compliance plays a pivotal role in driving the Pharmaceutical Coating Equipment Market. Coated pharmaceutical products must meet strict regulatory standards for quality, efficacy, and patient safety. Pharmaceutical coating equipment that ensures uniform coating application, accurate dosing, and adherence to Good Manufacturing Practices (GMP) is crucial for compliance with regulatory requirements. The industry's commitment to maintaining high-quality standards drives the adoption of advanced coating equipment with features such as real-time monitoring, process control, and validation capabilities.

Global healthcare trends and the growing demand for pharmaceuticals contribute to the expansion of the Pharmaceutical Coating Equipment Market. As healthcare needs increase worldwide, pharmaceutical manufacturers are scaling up production to meet demand. Coating equipment becomes a critical component in the manufacturing process, enabling pharmaceutical companies to efficiently produce coated dosage forms that meet the diverse requirements of patients and healthcare providers. The market's growth is closely linked to the overall expansion and globalization of the pharmaceutical industry.

Market competition and industry collaborations are notable factors influencing the Pharmaceutical Coating Equipment Market. The market consists of a mix of equipment manufacturers, suppliers, and pharmaceutical companies. Collaboration within the industry supply chain, including partnerships between coating equipment manufacturers and pharmaceutical formulators, contributes to the development of tailored solutions, efficient processes, and advancements in coating technologies. Partnerships also foster the integration of coating equipment with other pharmaceutical manufacturing processes, promoting seamless production workflows.

Challenges related to customization, validation, and the need for high precision are factors that the pharmaceutical coating equipment industry addresses. Pharmaceutical manufacturers often require customized coating solutions to meet specific formulation and dosage form requirements. Coating equipment providers strive to offer versatile and customizable solutions that cater to diverse pharmaceutical products. Additionally, validation of coating processes is a critical aspect to ensure consistent quality and compliance with regulatory standards. The industry continually invests in developing validated processes and equipment that align with industry best practices.

Leave a Comment