Market Share

Pharmaceutical Filtration Devices Market Share Analysis

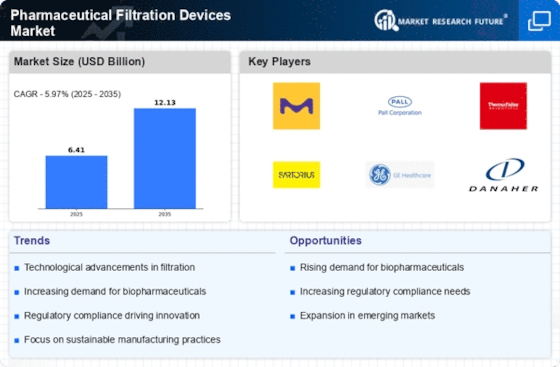

Companies need strategic market share positioning to succeed in the pharmaceutical filtration equipment industry, which is essential to pharmaceutical manufacture. The industry needs strong strategies to stay competitive and succeed. Due to rapid technology advances and changing regulatory requirements. Many of the biggest pharmaceutical filtration device firms prioritize filtration technology development. Research and development are underway to improve pharmaceutical product quality, processing speed, and filtering efficiency. Because they prioritize technological innovation, pharmaceutical businesses can fulfill the industry's changing needs with cutting-edge solutions. Strategic market leaders understand the advantages of a varied product line. Companies purposely provide a variety of filtering systems for various pharmaceutical manufacturing phases. This avoids concentrating on one filtering device type. This method guarantees a wide choice of options to meet pharmaceutical companies' numerous demands. Customizing filtration devices for pharmaceutical applications is a key market positioning strategy. Businesses provide several configurations, materials, and filter sizes to satisfy pharmaceutical manufacturing needs. People are better and more loyal with this way because it works with what pharmaceutical firms want. It is very important for people who work in pharmacies to follow the rules set by lawmakers. The people who work in the filtration device market put following the law at the top of their list of goals to make sure their products meet quality and safety standards. Because of this dedication, drug companies trust the group to make great medicines. Partnerships with pharmaceutical companies are essential for market share positioning. These strategic alliances help filtering equipment makers understand pharmaceutical manufacturers' demands and concerns. Collaboration often leads to customized solutions and smooth integration of filtering equipment into pharmaceutical drug manufacturing. Since the pharmaceutical sector is worldwide, successful companies purposefully develop their markets abroad. Companies expanding into overseas markets face several regulatory and manufacturing challenges. In addition, they expand their consumer base. Firms actively serve select areas to become global pharmaceutical filtration leaders. One strategic concern for industry leaders is the transition toward single-use technologies. Single-use filtration systems reduce pollution, operational costs, and production flexibility. Companies that prioritize single-use filtration device research, development, and marketing may stay competitive and keep up with industry advances. Strategic positioning to establish thought leadership in the pharmaceutical filtration device industry is working. Famous companies demonstrate their expertise via educational initiatives, training programs, and industry conferences. Due to their contributions to filtering technology knowledge and regulatory compliance, these enterprises improve their reputation and market perception. Effective marketing is needed to have a strong brand presence for market share assessment. Businesses must engage in persuasive and clear marketing to emphasize their filtration systems' unique features and advantages. To dominate the market, you need to build brand recognition and link the firm to innovation, customization, dependability, and rules.

Leave a Comment