- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

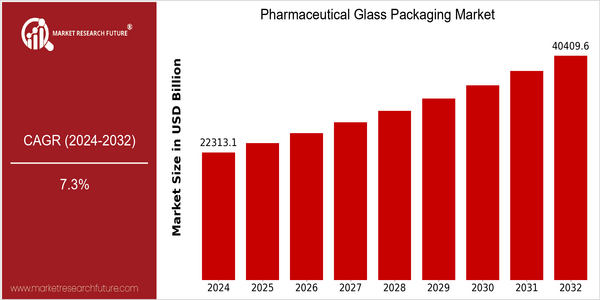

| Year | Value |

|---|---|

| 2024 | USD 22313.06 Billion |

| 2032 | USD 40409.6 Billion |

| CAGR (2024-2032) | 7.3 % |

Note – Market size depicts the revenue generated over the financial year

The pharmaceutical glass packaging market is expected to reach a value of $22,313,060,721 in 2024 and to reach $ 40,409,607,579 by 2032. This represents a CAGR of 7.3% over the forecast period. This upward trend is driven by the growing demand for safe and effective drug delivery systems and the increasing prevalence of chronic diseases. Also, the increasing focus on sustainable packaging solutions and the technological advancements in glass manufacturing are driving the market. These factors are expected to continue to drive the market growth in the coming years. The major players in the pharmaceutical glass packaging market, such as Schott AG, Gerresheimer AG and Nipro Corp., are focusing on new product development and strategic alliances to strengthen their market presence. Recent initiatives to develop eco-friendly glass materials and smart packaging solutions are a clear indication of the shift towards sustainable and efficient packaging solutions. These strategic initiatives will have a decisive influence on the future of pharmaceutical glass packaging.

Regional Market Size

Regional Deep Dive

Among the pharmaceutical glass containers market the most prominent players are A.B. Glasses Pvt. Ltd., A.B. Glasses Industries Pvt. Ltd., and A.B. Glasses Industries Pvt. Ltd. In North America, the pharmaceutical industry is booming, and the pharmaceutical glass containers market is advancing in the direction of growth. In Europe, the focus is on sustainable and high-tech packaging solutions. In Asia-Pacific, rapid industrialization and the development of the pharmaceutical industry lead to the demand for glass packaging. The Middle East and Africa are characterized by emerging markets and increasing investments in the medical sector, while the pharmaceutical industry in Latin America is booming, which in turn drives the glass packaging market.

Europe

- The European Union's commitment to sustainability has led to a surge in demand for eco-friendly glass packaging solutions, with companies like O-I Glass investing in advanced recycling technologies.

- Regulatory changes in the EU regarding the use of single-use plastics are driving pharmaceutical companies to shift towards glass packaging, as seen with major players like Amcor adapting their product lines.

Asia Pacific

- The rapid growth of the pharmaceutical industry in countries like India and China is leading to increased investments in glass packaging, with local manufacturers such as Piramal Glass expanding their production capabilities.

- Innovations in smart packaging technologies, including the integration of IoT devices in glass containers, are being explored by companies like SGD Pharma, enhancing drug safety and tracking.

Latin America

- Brazil's pharmaceutical market is expanding rapidly, prompting local manufacturers to invest in glass packaging solutions to meet the growing demand for high-quality medicines.

- Regulatory changes in countries like Mexico are encouraging the use of glass packaging for pharmaceuticals, as it is perceived as a safer alternative to plastic.

North America

- In recent years, the Food and Drug Administration in the United States has imposed stricter regulations on the quality and safety of pharmaceutical packaging. This has led to a growing demand for high-quality glass containers such as those manufactured by Corning and Schott.

- Recent innovations in glass manufacturing, such as the development of lightweight and break-resistant glass, are being spearheaded by companies like Gerresheimer, enhancing the appeal of glass packaging in the pharmaceutical sector.

Middle East And Africa

- The Middle East is witnessing a rise in pharmaceutical manufacturing, with governments like the UAE investing in healthcare infrastructure, which is boosting the demand for glass packaging solutions.

- Regulatory bodies in Africa are increasingly focusing on improving drug safety standards, leading to a greater emphasis on high-quality glass packaging from companies like Nampak.

Did You Know?

“Approximately 70% of all pharmaceutical products are packaged in glass containers, primarily due to their inert nature and ability to preserve the integrity of the contents.” — International Society for Pharmaceutical Engineering (ISPE)

Segmental Market Size

The pharmaceutical glass packaging business is a crucial one, playing a key role in ensuring the safe and effective use of medicines. The business is currently experiencing a steady growth. A growing need for high-quality, contamination-free packaging and strict regulations requiring the use of glass for certain pharmaceuticals are the main drivers of this growth. Moreover, the increasing use of biological medicines and injections requires reliable, stable packaging. The pharmaceutical glass packaging market has reached a mature phase of development. Companies like Schott AG and Gerresheimer are the leaders, offering a wide range of products. Vials, ampoules and syringes are the main products, with the latter being particularly important for the biotech and vaccine industries. In addition to the growing demand for pharmaceuticals, the growing trend towards sustainable development is boosting the market as pharmaceutical companies seek to reduce their impact on the environment. Furthermore, developments in production technology, such as fully automatic production lines and smart packaging solutions, are shaping the market, increasing the efficiency and safety of pharmaceutical distribution.

Future Outlook

During the period 2024 to 2032, the pharmaceutical glass packaging market is expected to grow at a CAGR of 7.3%. Its growth is based on the rising demand for high-quality, sterile packaging solutions to ensure the safety and integrity of pharmaceutical products. The pharmaceutical industry is expanding worldwide, driven by rising health care expenditures and the growing use of biologicals and injectables. Consequently, the demand for pharmaceutical glass packaging is also expected to grow. It is expected that by 2032 glass packaging will account for more than 30% of the pharmaceutical packaging market, demonstrating its key role in the industry. In addition, technological developments, such as the development of lighter and more durable glass materials, are expected to enhance the appeal of glass packaging. Also, regulatory support for sustainable and recyclability will drive the market for glass packaging. The integration of smart packaging, which can provide real-time information on the product conditions, is expected to be another trend that will influence the market. The pharmaceutical glass packaging market will continue to grow, as it is a crucial part of the pharmaceutical supply chain.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 5136.53 million |

| Growth Rate | 9.6 % (2024-2032) |

Pharmaceutical Glass Packaging Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.