- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

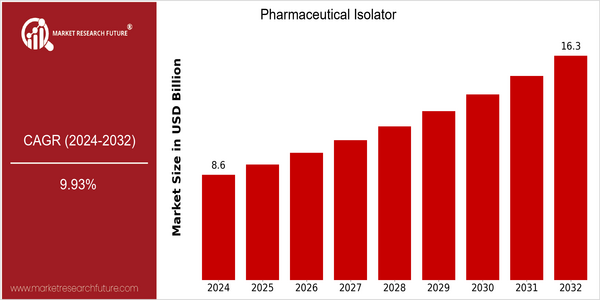

| Year | Value |

|---|---|

| 2024 | USD 8.58 Billion |

| 2032 | USD 16.29 Billion |

| CAGR (2024-2032) | 9.93 % |

Note – Market size depicts the revenue generated over the financial year

The pharmaceutical isolator market is expected to grow at a CAGR of 9.3 per cent over the forecast period, from a size of USD 8.58 billion in 2024 to a size of USD 16.29 billion in 2032. The growth rate is expected to reach a CAGR of 9.3 per cent during the forecast period. The increasing demand for sterile environments in pharmaceutical manufacturing, driven by stringent regulatory requirements and the rising prevalence of chronic diseases, is a major factor driving the market. Moreover, technological advancements, such as the integration of automation and real-time monitoring systems, are enhancing operational efficiency and safety, which is further driving the market. In order to increase their market share, major players, such as Getinge AB, Steris, and Fedegari Group, are launching new products and forming strategic alliances. In addition, the development of next-generation isolators is a clear indication of the industry's commitment to meeting evolving customer requirements and regulatory standards.

Regional Market Size

Regional Deep Dive

The pharmaceutical isolator market is experiencing significant growth in various regions of the world, driven by the increasing demand for sterile environments in pharmaceutical production and research. The market is also driven by stricter regulations, technological advancements, and the increasing focus on product quality and safety. North America leads in terms of innovation and regulatory framework, Europe focuses on compliance and sustainability, Asia-Pacific is experiencing rapid industrialization, the Middle East and Africa are developing their healthcare infrastructure, and Latin America is adapting to changing market needs.

Europe

- The European Medicines Agency (EMA) has introduced new regulations aimed at improving the quality of sterile products, prompting pharmaceutical companies to upgrade their isolator systems to meet these enhanced standards.

- Innovations in isolator design, such as the development of flexible isolators by companies like Bosch Packaging Technology, are gaining traction, allowing for more versatile applications in various pharmaceutical processes.

Asia Pacific

- Countries like China and India are ramping up their pharmaceutical manufacturing capabilities, leading to increased investments in isolator technology to meet both domestic and international quality standards.

- The rise of biopharmaceuticals in the region has spurred demand for isolators that can handle complex production processes, with companies like Eppendorf expanding their product lines to cater to this growing market.

Latin America

- Brazil's National Health Surveillance Agency (ANVISA) has been tightening regulations on sterile manufacturing, prompting local pharmaceutical companies to invest in isolator systems to comply with new standards.

- The region is seeing a trend towards the adoption of modular isolators, which offer flexibility and cost-effectiveness, with companies like Aseptic Technologies leading the way in providing innovative solutions.

North America

- The U.S. Food and Drug Administration (FDA) has recently updated its guidelines on aseptic processing, which has led to increased adoption of isolators in pharmaceutical manufacturing to ensure compliance with stringent safety standards.

- Key players like Getinge and STERIS are investing in advanced isolator technologies, such as robotic automation and integrated monitoring systems, enhancing operational efficiency and product safety.

Middle East And Africa

- The Middle East is witnessing a surge in healthcare investments, with governments like the UAE's pushing for advanced pharmaceutical manufacturing capabilities, thereby increasing the demand for isolators.

- Local companies are collaborating with international firms to enhance their isolator technologies, as seen in partnerships between Saudi Pharmaceutical companies and global leaders in isolator manufacturing.

Did You Know?

“Did you know that isolators can reduce the risk of contamination by up to 99.99%, making them essential in the production of sterile pharmaceuticals?” — International Society for Pharmaceutical Engineering (ISPE)

Segmental Market Size

The market for pharmaceutical isolators is currently experiencing a steady rise, driven by the increasing demand for a contamination-free environment in pharmaceutical production. The demand is also based on stricter regulations to ensure the safety and quality of products, and the growing complexity of biopharmaceuticals and sterile products. Among the companies at the forefront are Getinge and Steris, which provide isolator solutions that meet the regulations. The use of pharmaceutical isolators has reached a stage of maturity in North America and Europe, where the regulatory framework is well established. The main application areas are aseptic filling, compounding and research laboratories, with a notable application in Pfizer’s sterile production plants. In light of the COVID19 influenza pandemic, the demand for isolators has risen further. In addition, advances in automation and digital monitoring are shaping the market’s development, making it possible to work more efficiently and reliably in pharmaceutical production.

Future Outlook

The pharmaceutical isolator market is expected to grow significantly from 2024 to 2032, with a CAGR of 9.93%, and the market is expected to reach $8.58 billion by 2032. The main driving force for this growth is the increasing demand for sterile conditions in the pharmaceutical industry, especially in the manufacture of biological medicines and advanced therapies. The use of isolators will continue to increase as regulatory requirements for product safety and quality become stricter. By 2032, the penetration rate of isolators in the sterile production area is expected to be around 70%, up from the current 45.6%. Also, technological advances, such as the integration of automation and real-time monitoring systems, will greatly improve the efficiency and reliability of isolators. Also, the development of personalized medicine and the expansion of gene and cell therapies will require more advanced isolation equipment to ensure a sterile environment. The introduction of the European Medicines Agency and the Food and Drug Administration’s sterility guidelines will also increase the demand for isolation equipment, which will further boost the market. The market is evolving rapidly, and all parties need to be agile and take advantage of the new trends and technological developments, so as to meet the increasingly stringent requirements of the rapidly changing pharmaceutical industry.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 7.84 Billion |

| Growth Rate | 9.93% (2024-2032) |

Pharmaceutical Isolator Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.