Phase Transfer Catalyst Size

Phase-Transfer Catalyst Market Growth Projections and Opportunities

The market for Phase-Transfer Catalyst (PTC) is shaped by a number of factors which all together determine its pulsation and growth. A fundamental force behind the thriving of this market is the wide application of phase-transfer catalysts in chemical synthesis processes. PTCs ensure the interaction of reactants between the immiscible phases, generally between organic and aqueous phases, ensuring efficient and selective reactions.

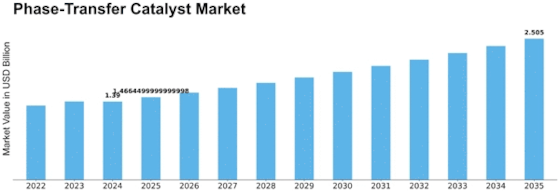

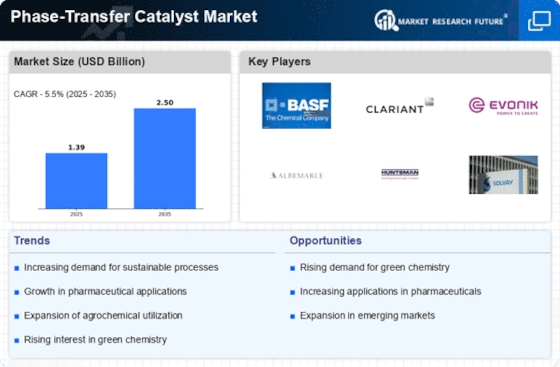

The Phase-Transfer Catalyst Market will reach an amount of USD 1321 million in 2023 with a rate of 5.5% during the forecast period. Inorganic synthesis of eco-friendly and green chemistry products contributes to market growth.

The chemical synthesis methodologies changes and the demand of more sustainable and efficient processes are so critical that they determine the market for Phase-Transfer Catalysts. As the industries move towards greener options and observe the manufacturing practices that are sustainable, the use of PTCs in prominence. PTCs play a significant role in the formation of sustainable processes lowering waste, improving selectivity, and letting to be milder reaction conditions unlike in the traditional methods.

The impact of technological progress in catalyst formulation and process optimization is huge on how the market changes. The process of on-going research and development produces innovations in PTC technologies. This enables more effective catalytic activity, stability and compatibility with different reaction conditions. On the other hand, high-level PTCs have been built to precisely serve industry demands facilitating chemists to achieve better yields and high selectivity in complex reactions.

The market environment is also affected by the growing scope of applications of phase-transfer catalysts in pharmaceutical and agrochemical industries. PTCs are used in the production of pharmaceutical intermediate, API, and agrochemical compounds. The development of these sectors, propelled by healthcare and agricultural breakthroughs, further drive the demand for PTCs to enable the course of relevant reactions.

Economic situations and industrial operations are the key determinants of Phase-Transfer Catalyst Market. The fate of chemical production, R&D investments, and the level of industrial production affect the demand for PTCs. Economies growth, globalized chemical supply chains and investments in innovation are the factors which determine the landscape of PTC usages.

It is the rivalry in the industry and the collaboration that shaped the market. PTC manufacturers ally themselves with chemical firms, research institutions, and others to increase the quality of their products, discover new applications, and gain a footing in the market. Partnership, merger, and acquisition contribute to the improvement of product lines, enhancement of market reach, and winning the intensely competitive PTC market.

Leave a Comment