Phosphate Size

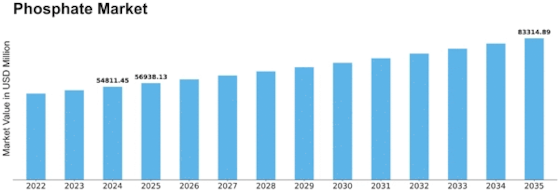

Phosphate Market Growth Projections and Opportunities

The Phosphate Market is complicatedly impacted by a blend of financial, horticultural, and natural variables, mirroring its critical job as a vital part in manures and different modern applications. Here is a compact breakdown of the key market factors in the phosphate business, introduced in a pointer design: Interest for Composts in Agribusiness: Phosphate's primary market driver is agriculture's demand for fertilizers based on phosphate. Phosphates are basic enhancements for plant improvement, propelling root headway, blooming, and fruiting. The worldwide interest for food and the need to improve farming efficiency contribute fundamentally to the interest for phosphate-based manures. Populace Development and Food Security: Populace development and the ensuing expansion in food request apply strain on horticultural frameworks. By expanding crop yields and tending to soil supplement lacks, phosphate manures contribute altogether to food security, especially in horticulturally concentrated districts. Worldwide Patterns in Biofuels and Environmentally friendly power: The developing spotlight on biofuels and environmentally friendly power sources impacts the phosphate market. Phosphates are utilized in the creation of biofuels and assume a part in manageable farming works on, lining up with the more extensive pattern towards sustainable and harmless to the ecosystem energy sources. Administrative Norms and Natural Worries: Tough ecological guidelines and worries about water contamination influence the phosphate business. Spillover from agrarian fields, containing phosphates from composts, can add to water contamination and eutrophication. Adherence to administrative guidelines and the advancement of harmless to the ecosystem rehearses are fundamental market factors. Phosphate Mining and Holds: The accessibility of phosphate rock holds and the productivity of phosphate mining activities impact the market. Changes in mining rehearses, international contemplations, and the investigation of new phosphate saves influence the general store network elements and valuing in the phosphate market. Innovation in Phosphate Handling: Phosphate processing's technological advancements contribute to increased sustainability and efficiency. Advancements in extraction, beneficiation, and handling advances upgrade the general efficiency of phosphate mining and handling activities, affecting business sector seriousness. Worldwide Financial Circumstances: The phosphate market is impacted by worldwide monetary circumstances, including elements like Gross domestic product development, industrialization, and foundation advancement. Monetary dependability and development add to expanded interest for phosphate in modern applications, including the creation of cleansers and synthetic compounds. Phosphate-Based Creature Feed Enhancements: Phosphates are critical parts in creature feed supplements, supporting the development and soundness of animals and poultry. The interest for great meat and dairy items adds to the requirement for phosphate-based feed added substances, affecting business sector patterns in the agrarian area. Phosphate in Water Treatment: Phosphates find applications in water treatment processes, especially in controlling the degrees of supplements in water bodies. The avoidance of green growth development and the moderation of water contamination add to the interest in phosphates in metropolitan and modern water treatment applications. Improvement of Feasible Horticulture Practices: The phosphate market is affected by the trend toward environmentally friendly farming methods. Natural cultivating and accuracy agribusiness might influence the sort and number of manures utilized, influencing the general interest for phosphate-based composts. Innovative work in Phosphate Options: Continuous innovative work exercises centre around finding options in contrast to conventional phosphate sources. Endeavours to find more manageable and harmless to the ecosystem phosphorus sources, like reusing and creative advancements, may affect the future elements of the phosphate market. Worldwide Exchange and Production network Elements: The phosphate market is dependent upon worldwide exchange examples and inventory network elements. Changes in exchange connections, import-send out approaches, and transportation operations can affect the accessibility and evaluating of phosphate items in various areas. Phosphate Reusing and Roundabout Economy Drives: The phosphate market is influenced by recycling initiatives and the concept of a circular economy. Endeavours to recuperate and reuse phosphates from wastewater, rural buildups, and modern cycles add to feasible practices and may affect market elements. Changes in Buyer Conduct and Mindfulness: Shopper mindfulness and inclinations with respect to maintainable and harmless to the ecosystem items can affect the phosphate market in a roundabout way. Interest for food items delivered utilizing feasible agrarian practices might impact the selection of manures and phosphorus sources.

Leave a Comment